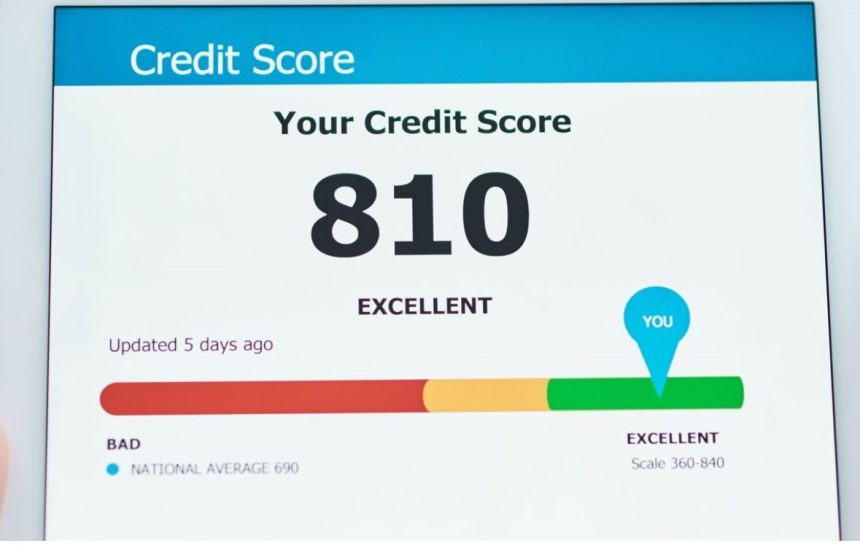

What lowers your credit score? This question worries many who are faced with the need to apply for a loan. Indeed, with an insufficient number of points, the chance of receiving the requested amount is very low. In addition, this imposes restrictions on the ability to use a number of other services.

What negatively affects credit rating?

There are many reasons why a credit rating may be lowered. Let’s talk about the main ones.

Delays are one of the biggest reasons. It is displayed on the rating of the most deplorable. Allowing delays, the client loses a maximum of points. The number of points is also extremely negatively affected if the client receives a penalty for late payment.

Another reason is that the client takes too much credit. Specialists, when making a forecast, evaluate it as one of the possible reasons that the client simply cannot cope with such a credit burden.

Another reason for the downgrade may be that the client sends too many requests for credit funds in a short period of time. This takes points even if these applications were not approved. After all, experts regard this as an urgent need for funds, which may indicate a poor financial situation. Accordingly, the chance that the client will return the money is very low.

A large number of points are also written off if the client has legal penalties. This applies not only to loans, but also to any other payments. For example, if a banking institution receives information that a client is not paying child support, this will also negatively affect the overall state of the rating.

Litigation also does not add points. For example, if a client was sued, and after the decision to enforce the recovery of funds, the specified amount was not paid within 10 days, this information will be included in the history. Accordingly, this will negatively affect the credit rating. So the lender will be wary of the borrower.

How to improve your credit score?

With a low credit score and a bad history, you severely limit your ability to get loans and access other financial services. That’s why it’s so important to work to ensure that you have the required number of points.

If necessary, you can also use the credit rating enhancement service. This is the most simple and accessible service for everyone with extensive functionality.

All users receive advice from experienced professionals, as well as an in-depth audit that allows you to identify problems in a timely manner and prevent their aggravation. With the help of the service, you can also track the dynamics and progress.

Scobooster is your chance to improve credit score and build a positive credit history by correcting all the mistakes.