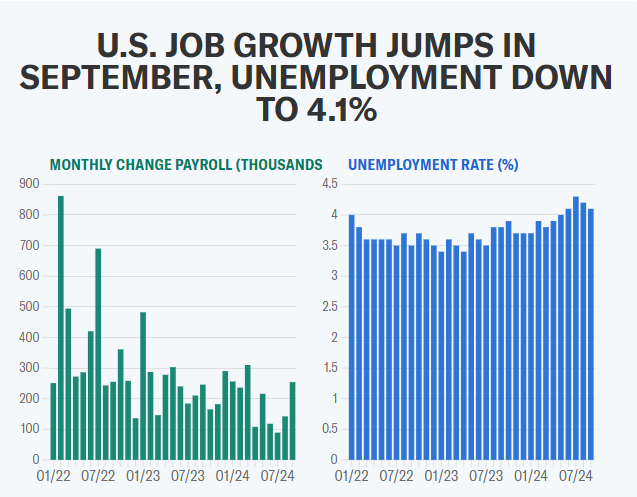

In September, the US labour market added considerably more jobs than anticipated, and the unemployment rate unexpectedly crept down, painting a brighter image of the jobs market than Wall Street had anticipated.

According to data from the Bureau of job Statistics released on Friday, more payrolls were added to the job market in September than economists had predicted—254,000—.

In the meantime, the jobless rate decreased from 4.2% in August to 4.1%. The revised 159,000 new jobs added in August were surpassed by the September numbers. According to revisions to both the July and August reports, the US economy created 72,000 more jobs in July and August than originally recorded.

A crucial indicator of inflation pressures, wage growth increased to 4% year over year in August after growing by 3.9% annually in August. Wages grew by 0.4% every month, consistent with the August estimate.

Before Friday’s report, the main concern was whether the statistics would show a noticeable slowdown in the job market, which would lead to another big interest rate decrease by the Federal Reserve. According to senior global economist Robert Sockin of Citi, the better-than-expected employment data told Yahoo Finance that the Fed is less likely to act with the “urgency” it displayed at its September meeting when it lowered interest rates by half a percentage point.

He said, “This pushes the Fed out a lot,” and doubted that the Fed will reduce interest rates by 50 basis points this year.

According to the CME FedWatch Tool, following the release, markets were pricing in an approximately 12% likelihood that the Fed will lower interest rates by half a percentage point in November, down from a 53% chance observed a week before.

“The real debate at the Fed should be about whether to loosen monetary policy at all, given the strength of the labor market as demonstrated in September’s employment report,” Paul Ashworth, chief North American economist at Capital Economics, said in a note to clients on Friday. “Any hopes of a [50 basis point] cut are long gone.”

On the news, futures linked to the main US stock indexes increased. Futures on the S&P 500 (ES=F) increased by about 0.8%, while futures on the Dow Jones Industrial Average (YM=F) increased by almost 0.5%. The tech-heavy Nasdaq 100 (NQ=F) saw a 1.1% increase in contracts.

Following the publication, Neil Dutta, head of economics at Renaissance Macro, stated in a note that the September jobs data was “undeniably good news” for the equities market.

“At the end of the day, the Fed is still cutting policy rates even as the economy grows,” noted Dutta.