Head and Shoulders is a popular technical analysis pattern used by traders to predict the future trend of an asset, such as stocks, cryptocurrencies, and commodities. The pattern gets its name from the distinctive shape it forms on the price chart, resembling a human head with two shoulders. The formation of this pattern signals a potential trend reversal, and traders can use it to determine entry and exit points in the market. In this post, we will explore what the head and shoulders pattern is, how to recognize it, and what it means for traders.

Before we dive into the head and shoulders pattern, it’s important to note that there is also an inverse head and shoulders pattern. The inverse head and shoulders pattern is similar to the head and shoulders pattern, but instead of signalling the end of an uptrend, it signals the end of a downtrend. This pattern signals a potential reversal and the start of a new uptrend. Let’s try to discuss everything you should know about head and shoulders pattern.

What is the Head and Shoulders Pattern?

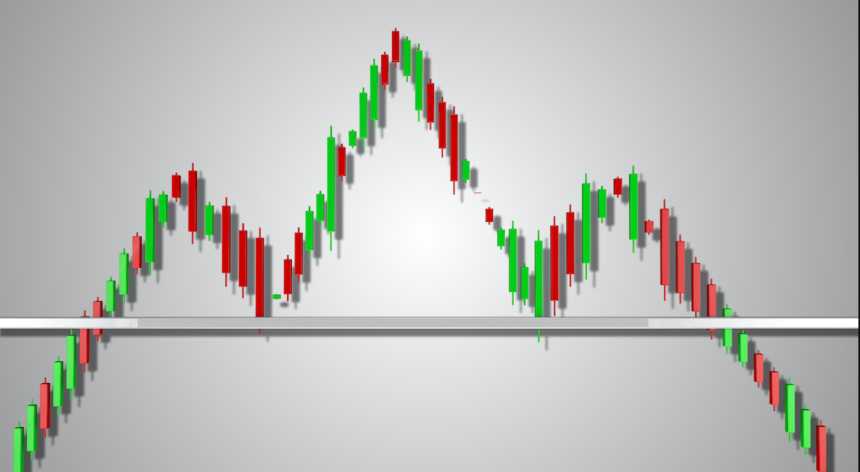

The Head and Shoulders pattern is a reversal pattern that signals the end of an uptrend and the start of a downtrend. It is formed when the price of an asset makes three successive peaks, with the middle peak being the highest.

The two smaller peaks on either side of the middle peak are the shoulders, and the middle peak is the head. The pattern is considered complete when the price of the asset falls below the neckline, which is the line connecting the lows of the two shoulders. The break of the neckline is a bearish signal, and traders use it to enter short positions or exit long positions. The head and shoulders pattern is a highly reliable reversal pattern and is considered to be one of the strongest signals in technical analysis. This pattern signals a potential change in trend direction, which traders can use to their advantage.

What is the inverse head and shoulders pattern?

The Inverse Head and Shoulders pattern is the opposite of the Head and Shoulders pattern and signals the end of a downtrend and the start of an uptrend. It is formed when the price of an asset makes three successive lows, with the middle low being the lowest.

The two higher lows on either side of the middle-low are the shoulders, and the middle low is the head. The pattern is considered complete when the price of the asset rises above the neckline, which is the line connecting the highs of the two shoulders. The break of the neckline is a bullish signal, and traders use it to enter long positions or exit short positions.

Are you looking for a trading platform to trade the head and shoulders pattern?

We recommend using Margex for your trading needs, as it provides a secure and user-friendly platform for traders of all levels. With Margex, you can access a wide range of assets, including cryptocurrencies, stocks, and commodities, and trade with confidence. One of the best ways to take advantage of the head and shoulders pattern is to trade it on a platform like Margex. It is a leading cryptocurrency trading platform that offers traders the ability to trade a wide range of digital assets, including Bitcoin, Ethereum, and many others. With its advanced trading tools and user-friendly interface, Margex makes it easy for traders to capitalize on the head and shoulders pattern.

How to Trade the Head and Shoulders Pattern?

Trading the head and shoulders pattern is relatively straightforward. Traders look for the formation of the pattern on the price chart and wait for the price to break below the neckline for a bearish signal. They then enter short positions and set their stop-loss just above the head. The target profit is usually set at the distance from the head to the neckline, measured from the point of the break.

For the inverse head and shoulders pattern, traders look for the formation of the pattern on the price chart and wait for the price to break above the neckline for a bullish signal. They then enter long positions and set their stop-loss just below the head. The target profit is usually set at the distance from the head to the neckline, measured from the point of the break.

Conclusion

Overall, the head and shoulders pattern is a reliable reversal pattern that signals the end of one trend and the start of a new one. Whether you’re a seasoned trader or just starting out, it’s important to understand this pattern and how to recognize it. With the help of a platform like Margex, you can take advantage of this pattern and potentially profit from changes in market trends.