Political News:

It’s time to holiday shop.

especially merry for many retailers. Unemployment is at 50-year lows, wages are on the rise and major stock market indices are up over 20% on the year.” data-reactid=”17″ type=”text”>Black Friday officially kicks off on Thanksgiving Day, with retailers from J.C. Penney to Best Buy swinging open their doors early to capture deal-seeking consumers. And this year has the setup to be especially merry for many retailers. Unemployment is at 50-year lows, wages are on the rise and major stock market indices are up over 20% on the year.

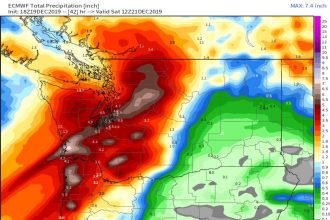

The only wildcard: how turbulent winter weather in parts of the West Coast and Northeast impact the travel decisions of shoppers.

The First Trade.” data-reactid=”19″ type=”text”>“I think the consumer is poised to show up [for Black Friday] in a semi big way. I think we are going to see solid sales and will be very happy with the results, but it will be spread out. Not just on Black Friday, but more sales on Cyber Monday and online,” said Invesco chief market strategist Kristina Hooper on Yahoo’s Finance’s The First Trade.

Target enters the holiday season with major sales momentum and a stock trading near a 52-week high. So how more upside could there be? Macy’s stock is plumbing fresh 52-week lows after an awful third quarter and outlook. Could Macy’s even be in the discussion as a holiday winner given how bad it has performed this year?” data-reactid=”20″ type=”text”>One of the million-dollar questions though is whether a strong start for retailers on Black Friday will power their stocks higher. The likes of Target enters the holiday season with major sales momentum and a stock trading near a 52-week high. So how more upside could there be? Macy’s stock is plumbing fresh 52-week lows after an awful third quarter and outlook. Could Macy’s even be in the discussion as a holiday winner given how bad it has performed this year?

Indeed, it’s a stock picker’s market when it comes to the retail space right now.

“From a stock picking perspective, it’s still a stock picker’s market. It has been for years because of the changes going on in the retail industry. I think those best in breed retail names can continue to outperform. The companies have the formula down and they just have to milk it,” believes Sevens Report Research founder Tom Essaye.

Stay plugged in with my Black Friday live blog as I hit the road to tour stores in New York, talk to shoppers and email with retail executives.

6:00 p.m. ET Big day for online shopping continues

Online sales strengthened throughout Thanksgiving Day, echoing my observations made below on less than stellar store traffic.

Shoppers spent $2.1 billion online as of 5 p.m. ET, up 20.2% year over year, according to Adobe Analytics. Spending is expected to surpass $4 billion on Thanksgiving Day for the first time.

All in all, what we are witnessing thus far is indicative of the healthy financial position many consumers find themselves in this year.

Time for a shout out

There is a side story to walking around the malls and stores on Black Friday. It’s a great time to see who in retail is trying new things and if they make sense. This is supposed to be the busiest time of the year for retail, and experimenting a bit amidst high levels of traffic is welcomed.

Shout out to American Eagle Outfitters. A newly remodeled location I visited not only had revamped floors, tables and lighting — making it feel like a hipper place — but they installed a denim customization shop at the front of the store. Nice win here, none of the company’s teen apparel rivals have one of these in their stores.

The company has been one of the better performing mall retailers these past two years. Staying on the pulse of the shopper is why, so I am not surprised by this new denim service.

Customization is in when it comes to apparel, or so this aging millennial has been told.

5:00 p.m. ET Let the games begin

@BrianSozzi with photos if you are in the malls this evening. I have to say that at the two malls I have hit at around the time of their openings, the traffic feels lower versus last year. And to me, traffic a year ago on Thanksgiving Day wasn’t anything to write home about.” data-reactid=”36″ type=”text”>Please do tweet @BrianSozzi with photos if you are in the malls this evening. I have to say that at the two malls I have hit at around the time of their openings, the traffic feels lower versus last year. And to me, traffic a year ago on Thanksgiving Day wasn’t anything to write home about.

It’s clear that same-day delivery services have sucked the thrill out of Black Friday shopping. Ditto to the traffic.

FYI, Macy’s is super promotional from the get go.

2:00 p.m. ET J.C. Penney greets shoppers

I have been to each one of J.C. Penney’s early Thanksgiving Day openings — that was a tradition started with former CEO Marvin Ellison (now Lowe’s CEO) back in 2014 via a 5:00 p.m. ET opening. Every time the crowds have snaked around the store, and today’s opening was no different.

But in general, I was letdown by the crowd size this time compared to a year ago. Another potential red flag for investors in J.C. Penney is that the company looked more promotional on apparel staples (coats) and housewares. Apparel inventory seemed high likely due to the continued delay in cold weather.

Also worth mentioning is the unproductive floor space at J.C. Penney now that it no longer sells appliances. To be sure, CEO Jill Soltau has her work cut out for her to improve sales per square foot at stores that remain way too big.

See various posts below.

11:00 a.m. ET Dueling online sales data

Investors are usually hit with a ton of third-party sales data on the week of Black Friday to dissect. This one is no different.

New research out of Salesforce shows that digital sales for the Tuesday and Wednesday ahead of Thanksgiving rose 9% to $4.9 billion. Salesforce projects digital sales on Thanksgiving will gain 17% to $4.1 billion.

The numbers here aren’t as robust as those from Adobe Analytics. But they still paint a picture of a U.S. consumer out there spending nicely on deals across electronics, toys, apparel, etc.

10:00 a.m. ET Online sales start hot

The first batch of online sales data for Thanksgiving is in, and it looks pretty appetizing.

Through 10 a.m. ET, online sales have increased 14.5% from the prior year to $470 million according to Adobe Analytics.

Adobe Analytics estimates today’s online sales will grow 14.5% year-over-year to $4.2 billion. The day before Thanksgiving saw online sales surge 22% from last year.

“The strong online sales performance to-date suggests that holiday shopping starts much earlier than ever before. Steep discounts on popular items like computers on the day before Thanksgiving indicate that many of the season’s best deals are already up for grabs. This has led to significant growth in online sales (16.1% YoY increase) so far. What will be important for retailers to track is whether the early discounts will drive continued retail growth overall, or if they have induced consumers to spend their holiday budgets earlier, said Jason Woosley, vice president of commerce product & platform at Adobe.

9:00 a.m. ET Surrounded by retail apocalypse

Four store visits — three Walmarts and one beat-up Kmart — in the books in the Long Island, N.Y. area. The crowds are always non-existent before noon on Thanksgiving Day. Those who are out (besides my crazy self) are shopping for last-minute food for the holiday dinner table. So, no real clues just yet on how the holiday shopping season will begin for retailers in their stores, way too early.

But what has struck me in driving around is another year of retail death. Stores going out of business. Entire shopping centers dark, empty and haunting. To those who say the retail apocalypse is over, I say get a damn clue. With Amazon, Walmart and Target leading the way on same-day delivery for online orders I think investors in mall real estate investment trusts (REITs) and well-known retailers not named Amazon, Walmart and Target will be shocked by the number of store closures over the next few years. As those stores close, retailers essentially cede ground to the strong — in this case Amazon, Wa