Time and tide wait for no one. This can’t be truer than in this digital age, where time is considered money. Hence managing your time can save you money.

Money matters can be stressful when we have little time and a lot of financial decisions to make. We have now developed ways to reduce the mental load so that we have more time to make more complex decisions and attend to more pressing matters.

Automating your business and regular payments can help you carve out time and save money. So why waste your time setting aside time to make regular payments? Automation can save money in preventing late fees and black marks on your credit report simply because you forgot to pay a bill.

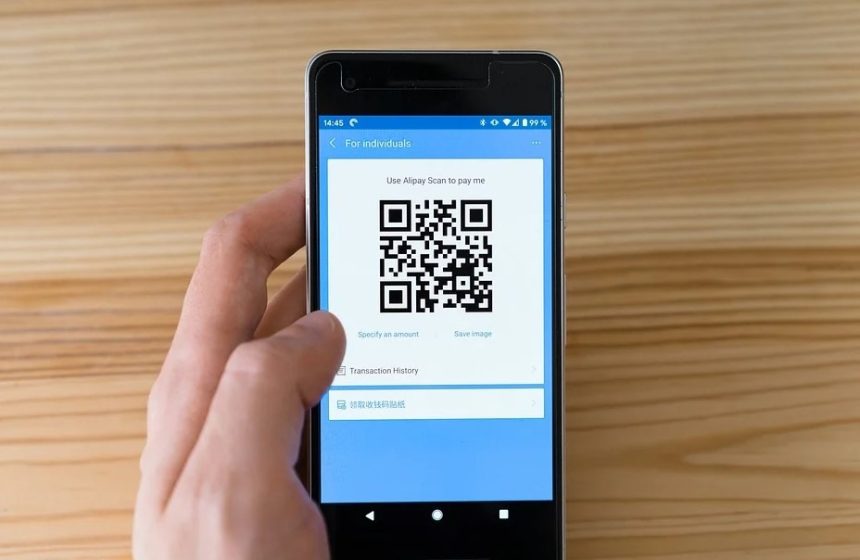

Internet banking and direct debit make it simple to automate much of your financial admin work. Once set up to handle your finances, life will be much easier. Here are some ways to simplify your finances in order to save time and money.

Steps to Automate Your Finances

Determine How Much

Before you automate your payments, sit down and determine a few things:

· Can you pay all of your bills on time?

· Or will you have trouble making timely payments?

· How has your history been with paying bills? Try to recollect if you frequently pay a few days late or if you are punctual with your payments.

If you have favourable answers to these questions and are financially secure, automating at least some of your monthly payments is good practice. And alternatively, if you don’t always have enough money in your account to cover your bills, you are not ready yet.

Set It Up

Sort your regular payments into three categories and decide whether you would like to automate them or manually make the payments for each of them.

1. Account Transfers

Set up automatic transfers from your salary account to your savings account and any debts you are trying to pay off. This ensures that your top priorities are handled and not overlooked.

2. Fixed Expenses

Rent, gym membership and insurance are best paid off automatically. You don’t need to review these regular bills because they are fixed charges.

3. Variables

Your monthly utility bills, such as phone, Internet and energy plans, are not fixed, but payments can still be automated. You should be careful and keep an eye on the amounts deducted. You can also pay a set monthly amount determined by your average usage. And any discrepancies are corrected at the end of the year.

What Can You Automate?

Your Finances

Automating your finances by setting up automatic online banking payments can also save you money. Simply schedule a transfer or payment for the day and amount you want to pay – just make sure your balance does not fall below a certain amount, or you risk overdraft. In this digital age, finding a company that does not offer autopay is difficult. When you automate payments, you will never forget to pay a bill or deal with unnecessary paperwork.

Subscription Services

Subscription services are convenient and are driving up sales. Food, beauty products, wine subscriptions and other services now offer monthly packs to choose from. Automating payments for these services makes it one less thing to deal with.

Credit Card Payments

You know you are ready to automate once you’ve mastered your credit card bills and paid the full balance every month. This is a costly bill if it is late even by a few days. Late fees and lost interest periods quickly add up and will be reflected on your credit report. Most credit card companies will allow you to set up an automatic payment on a date you prefer.

Final Tips

If you do not want to start automating just yet, set aside some time to review your purchases and your statements. This way, you can keep control of your money while also benefiting from the relief from stress and cost savings that automation provides.