Closing the books is one of the finance team’s most critical yet challenging tasks. It requires accuracy, timeliness, and compliance, which are often compromised when processes are manual and spreadsheet-driven. That’s where financial close software comes in. It helps streamline, automate, and control the close-to-disclosure cycle, ensuring efficiency and accuracy for growing organizations.

In this blog, we’ll break down what financial close software is, why it matters, and how it can empower your accounting team to close faster and smarter.

What Is Financial Close Software?

Financial close software is a specialized solution designed to automate and manage the accounting close process. It centralizes tasks such as journal entries, reconciliations, intercompany eliminations, and reporting. Instead of juggling spreadsheets, shared drives, and endless email chains, finance teams can use a single platform to ensure accuracy, compliance, and transparency across every step of the close.

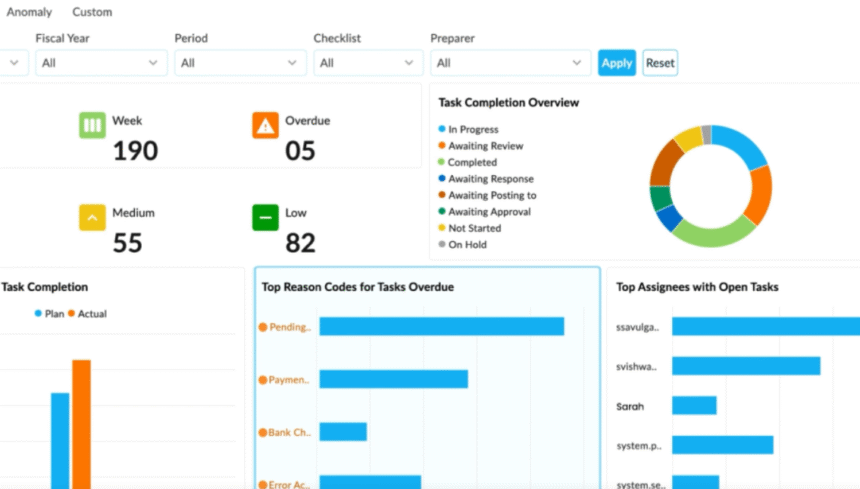

The software often integrates with ERP systems, allowing seamless data flow and reducing manual entry. By offering dashboards, workflows, and real-time visibility, financial close software helps accounting teams move from reactive firefighting to proactive, controlled closing.

Why Traditional Financial Close Is Broken

Many companies still rely on manual methods for closing the books. While spreadsheets may work in the early stages, they quickly become unsustainable as business complexity grows. Common challenges include:

● Delayed closes: Finance teams spend weeks reconciling accounts and preparing reports.

● Error-prone processes: Manual data entry increases the risk of mistakes and duplicate work.

● Poor visibility: Leadership often lacks real-time insights into financial performance.

● Audit struggles: Compliance becomes a recurring headache without clear documentation and audit trails.

● Team burnout: Staff spends long hours on repetitive tasks, leaving little room for strategic analysis.

These issues aren’t just operational; they directly affect cash flow visibility, investor confidence, and the ability to make timely business decisions.

How Financial Close Software Transforms the Process

Adopting financial close software helps eliminate these challenges. Here’s how:

1. Faster close cycles

Automation reduces manual reconciliations, journal postings, and approvals, enabling finance teams to close days faster. With real-time data syncing from ERPs and banks, you can avoid bottlenecks and speed up reporting cycles.

2. Improved accuracy and compliance

Rules-based automation minimizes human errors. The software also provides a clear audit trail for every transaction, making regulatory compliance easier and reducing audit costs.

3. Real-time visibility

Dashboards provide instant insights into close progress, outstanding tasks, and overall financial health. Instead of waiting until the end of the month, CFOs and controllers can track performance continuously.

4. Stronger collaboration

With centralized workflows, multiple stakeholders can collaborate within the platform, from accountants to auditors. Automated notifications, task assignments, and approvals prevent miscommunication and keep processes moving.

5. Scalability for growth

As businesses expand across regions and subsidiaries, complexity multiplies. Financial close software can handle multiple currencies, entities, and regulatory requirements, ensuring scalability without added manual effort.

Key Features to Look For in Financial Close Software

When evaluating a solution, look for features that match your organization’s needs:

● Automated reconciliations to match transactions quickly.

● Workflow management with task assignment and approvals.

● ERP integration for seamless data flow.

● Audit-ready reporting with detailed logs.

● Dashboards and analytics for real-time visibility.

● Multi-entity and multi-currency support for global businesses.

Choosing the right tool ensures your team gets maximum efficiency and accuracy.

Why Your Accounting Team Needs It Now

Today’s finance leaders are under pressure to deliver faster insights, maintain compliance, and support strategic decision-making. Without the right technology, accounting teams risk being stuck in a cycle of manual work, delays, and errors.

By investing in financial close software, your team gains:

● Time back: Automating repetitive tasks frees up capacity for analysis and planning.

● Confidence in numbers: With fewer errors, your team can trust the accuracy of financial reports.

● Compliance strength: Built-in audit trails and standardized workflows help meet regulations effortlessly.

● Employee satisfaction: Reducing late nights and repetitive manual work helps retain finance talent.

Ultimately, this isn’t just about efficiency; it’s about transforming the role of finance from record-keeping to strategic leadership.

Conclusion

Financial close is the backbone of accurate reporting and informed decision-making, but manual methods often hold accounting teams back. Financial close software solves these challenges by automating reconciliations, improving visibility, strengthening compliance, and reducing close timelines.

If your team spends weeks on month-end, struggles with errors, or faces audit pressure, now is the time to consider automation. Financial close software streamlines operations and empowers your accounting team to play a more strategic role in driving business growth.

The sooner you modernize, the sooner your finance function moves from closing the books to opening opportunities.