Do you need a short-term loan for an emergency? Do you need a fax machine to apply for a payday loan but can’t seem to find one?

If you answered yes, you’ll be relieved to discover that acquiring a short-term loan or instant no fax payday loan is much easier than you expected. You do not need to look for a fax machine to apply, nor do you need to pay someone to use their machine. The application procedure for fax-less loans is straightforward, and you may apply even if you have a poor credit score.

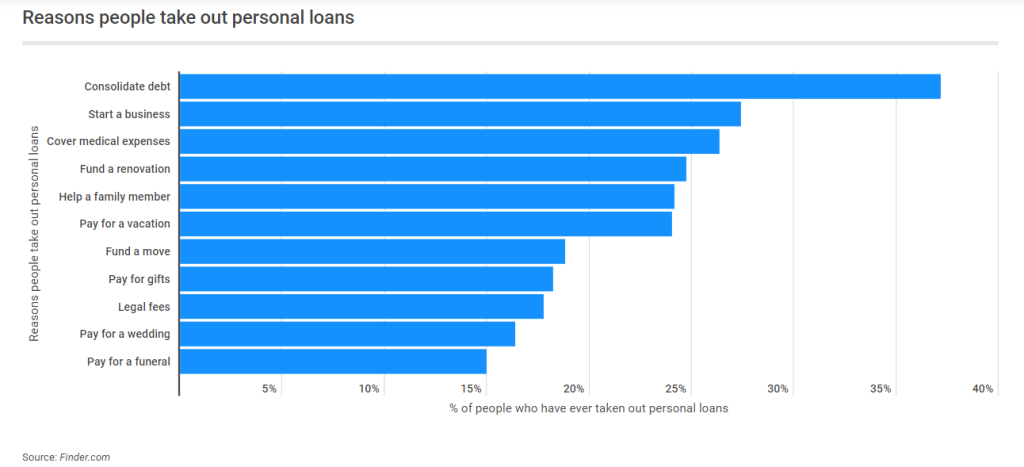

According to Finder Personal loans statistics research, short-term loans have grown in popularity as a means of supporting those who want immediate financial assistance. However, if the loan application procedure is not clear and easy, it might be irritating. Many payday lenders will still ask you to visit their physical offices or submit your application by fax.

You may be able to apply for a payday loan from the lender. Unfortunately, the alternative of visiting their physical site or sending a fax is not ideal, particularly for persons who reside in rural regions or do not have dependable, functional transportation.

What Exactly Is a No Fax Payday Loan?

A no fax payday loan is the same as a regular payday loan, except that you must fax your application instead of submitting it physically or online. This means you’ll either need to learn how to operate a fax machine or hire someone to do it for you.

The purpose of no fax payday loan application is to make the loan application procedure simple and uncomplicated for all borrowers. Most payday loans available online nowadays are faxless.

People seldom use fax these days, thanks to the invention of email and other contemporary modes of communication. After all, all you need to do to get started is scan and email your papers.

Furthermore, you won’t have to spend additional money attempting to have your application paperwork sent to the lender. Essentially, no-fax or no fax payday loans are simple short-term loans that are available to almost everyone in need of financial assistance.

Because faxless payday loans are the same as regular short-term payday loans, you may apply even if you have a poor credit history. And, in most cases, you’ll be required to repay the whole amount on your next salary.

Why Should You Consider Faxless Payday Loans?

It’s difficult to comprehend why any borrower would want to go through the hassle of faxing loan applications when there are simpler and less expensive alternatives. Because most individuals now have internet access, particularly on their mobile phones, utilizing the internet is your best and quickest choice for completing your loan application.

Even if you just have a mobile phone with an internet connection, you may apply for a faxless loan on the lender’s website from the comfort of your own home. Email, in fact, is virtually always simpler and faster to use in a number of scenarios. With today’s technological advancements, it is becoming more difficult to locate fax machines.

Even if you do locate one, working the equipment will be a problem. Faxing, on the other hand, is simple if you work in a workplace that employs fax. Otherwise, you’ll have to go to an office facility that costs you by the page or minute. If you reside in a remote region, you will have to travel to the fax center.

Most fax payday loans are now faster, more convenient, and frequently less expensive than a traditional cash advance that involves the use of a fax machine. You do not need to look for a fax machine to apply, nor do you need to pay someone to use their machine. Also, keep in mind that the loan amount you qualify for may be determined by your existing financial situation and credit score.

Is A Credit Check Required For A Faxless Payday Loan?

No. No, you don’t. In general, instant payday loans online guaranteed approval do not need a credit check. Remember, this is a rapid loan with no collateral required. Paycheck loans are also known as cash advances since the lenders simply advance you money that you will repay on your next payday.

Application Requirements for a No Fax Payday Loan

Obtaining no-denial payday loans direct lenders only is a lot simpler than it used to be; you may quickly apply for loans without the usage of a fax machine. However, you must satisfy certain prerequisites.

Direct lenders, for example, will make a decision on your loan application immediately. The following are examples of eligibility requirements:

- You must live in a state where the lender is legally permitted to operate.

- You must be at least 18 years old to apply.

- You have an active checking account that allows electronic transactions.

- A working phone number and an email address

- A current mailing address

You are also eligible if you are not a current military member and are not dependent on an active military member.

Also, be sure you’re not in any other debts that might jeopardize your chances of acquiring a loan.

What Is the Average Time It Takes to Get a Payday Loan?

The application process is simple and uncomplicated. All you have to do is fill out the online application form and submit it. The firm receives and evaluates your inquiry. You will be reimbursed within 24 hours. It usually just takes a few minutes to determine your eligibility. After that, the cash is deposited into your account.

Conclusion. Is a Payday Loan the Right Choice for Me?

Faxless payday no credit check loans guaranteed approval are popular since they are simple to get. If you’re still in debt somewhere, you could have trouble acquiring a new loan. However, the good news is that it does not need faxing, collateral, or a background check, and it is available to persons with terrible credit.