A Roth IRA is traditionally used as a retirement savings vehicle, offering tax-free growth and withdrawals in retirement. However, some individuals consider using a Roth IRA as an emergency fund due to its unique withdrawal flexibility. While this approach has certain advantages, it also carries risks that could impact long-term financial stability. In this article, we will explore the pros and cons of using a Roth IRA as an emergency fund.

Pros of Using a Roth IRA as an Emergency Fund

One of the main benefits of a Roth IRA is its ability to serve as both a retirement savings tool and a potential financial safety net. Below are some key advantages of using a Roth IRA for emergencies.

1. Tax-Free Withdrawal of Contributions

Unlike traditional IRAs, Roth IRAs allow you to withdraw your contributions (but not earnings) at any time without penalty or tax implications. This means that if you have been contributing for several years, you can access the money you originally put in without incurring additional costs. This feature makes it an attractive option for those who want a dual-purpose savings account.

2. Potential for Higher Growth Compared to Traditional Savings Accounts

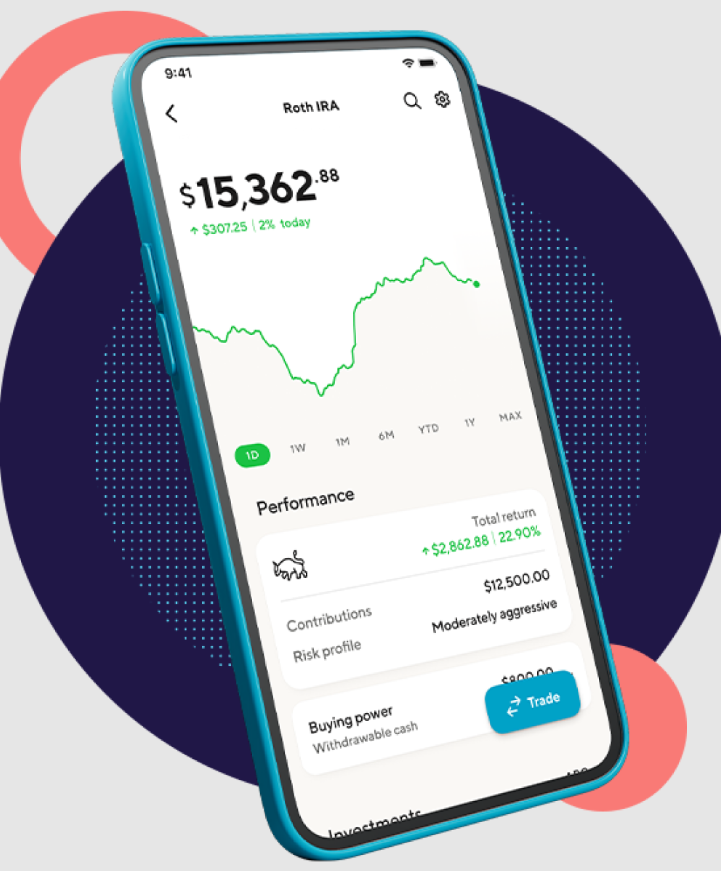

A Roth IRA allows investments in assets such as stocks, bonds, and mutual funds, which typically yield higher returns than traditional savings or money market accounts. If you do not end up needing the funds for an emergency, the money continues to grow tax-free for retirement.

3. IRA Payout Calculator Can Help with Financial Planning

When considering using a Roth IRA for emergency expenses, it is essential to evaluate the potential impact on your retirement savings. An IRA payout calculator can help you project the effects of withdrawing contributions early, ensuring that you maintain financial security in the long run.

4. No Required Minimum Distributions (RMDs)

Unlike traditional IRAs, Roth IRAs do not have RMDs, meaning you are not forced to withdraw funds at a certain age. This provides more flexibility in managing your retirement savings, even if you occasionally use some funds for emergencies.

Cons of Using a Roth IRA as an Emergency Fund

While there are benefits to using a Roth IRA for emergencies, there are also significant drawbacks to consider before tapping into this valuable retirement resource.

1. Risk of Hindering Long-Term Retirement Savings

One of the biggest downsides to using a Roth IRA for emergencies is that any money withdrawn reduces the overall growth potential of the account. Even though you can replace the funds later, missing out on compounding interest can impact your retirement savings over time.

2. Restrictions on Earnings Withdrawals

While you can withdraw contributions penalty-free, the same is not true for earnings. If you withdraw earnings before age 59½ and before the account has been open for five years, you may be subject to a 10% early withdrawal penalty and income taxes. This can make withdrawing more costly than expected.

3. Investment Risks

Unlike a traditional emergency fund kept in a high-yield savings account, Roth IRA funds are often invested in market-based assets. If an emergency arises during a market downturn, you may have to sell investments at a loss to access the needed funds.

4. Opportunity Cost of Using Roth IRA for Emergencies

Roth IRAs have annual contribution limits ($7,000 for individuals under 50 and $8,000 for those 50 and older in 2024). Once you withdraw funds, you might not be able to recontribute them if you have already reached your annual limit. This limits the potential for future tax-free growth.

Conclusion: Is a Roth IRA a Good Emergency Fund Option?

Using a Roth IRA as an emergency fund has its advantages, particularly due to the ability to withdraw contributions tax-free. However, it is not without risks, as withdrawals can disrupt long-term retirement savings and expose funds to market volatility.

Before using a Roth IRA for emergency savings, consider other options, such as a dedicated high-yield savings account or a separate emergency fund.

If you choose to use your Roth IRA as a backup emergency fund, ensure you have a clear plan to replenish any withdrawn contributions to maintain its long-term benefits. Tools like an IRA payout calculator can help assess the impact of early withdrawals and aid in financial planning.