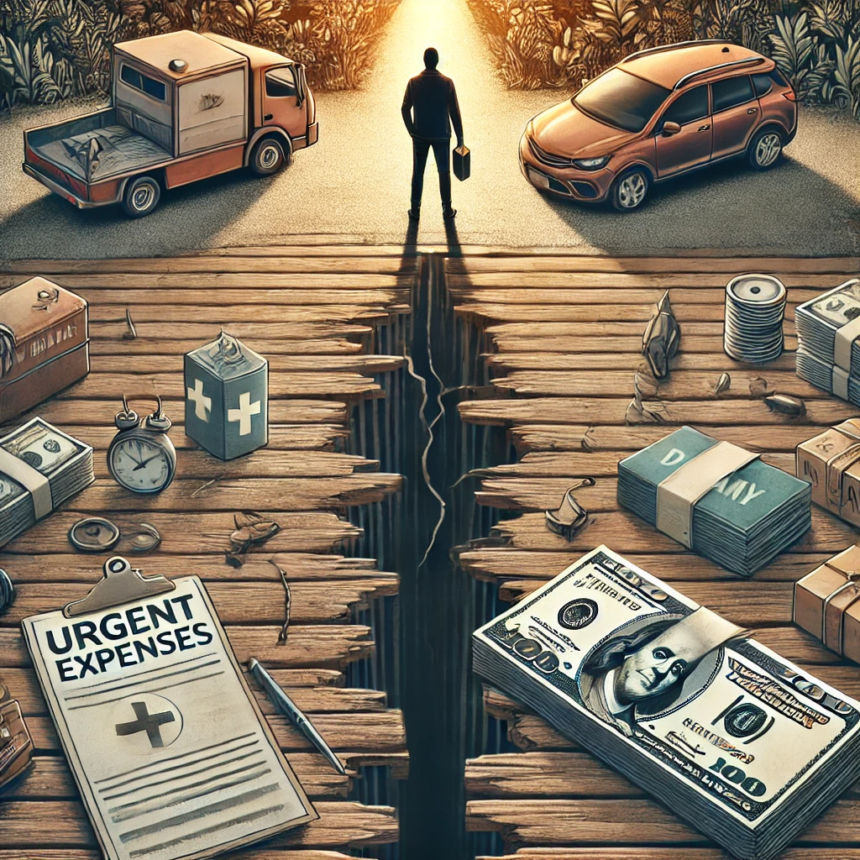

Financial emergencies have a way of arriving unannounced, demanding swift action and testing our resourcefulness. In an ideal world, a well-padded savings account would handle any surprise expenses, but reality often presents more complex scenarios. Navigating short-term financial gaps requires more than just luck—it demands smart, flexible strategies. From leveraging side income opportunities to tapping into external resources, here’s a comprehensive approach to regaining financial control.

Identifying the Source of Financial Strain

Before tackling any financial problem, it’s crucial to identify the root cause. Is it an unexpected car repair, medical expense, or perhaps an income disruption? Understanding the reason behind your shortfall will not only help you find immediate solutions but also allow you to build preventive measures for the future.

Common causes of short-term financial gaps include:

- Emergency expenses (repairs, medical bills)

- Irregular income or job loss

- Overspending or poor budgeting

By categorizing the nature of the financial strain, you can create a targeted action plan that mitigates the immediate impact while setting the stage for long-term stability.

Reevaluating Your Budget

A temporary cash crunch often calls for immediate reevaluation of your monthly budget. This doesn’t necessarily mean living with extreme frugality, but rather identifying areas where you can make short-term sacrifices.

Steps to Reevaluating Your Budget:

- Categorize Expenses: Separate essentials such as rent, groceries, and utilities from discretionary expenses.

- Cut Back on Non-Essentials: Reduce spending on entertainment, dining out, or subscriptions until your financial situation stabilizes.

- Set Priorities: Rank your expenses in order of importance. Make sure basic needs and debt repayments are prioritized.

Even small adjustments, such as cooking at home more frequently or pausing streaming services, can make a noticeable difference when compounded over a month.

Exploring Side Income Opportunities

If cutting costs alone isn’t enough to bridge the gap, consider boosting your income through side hustles or temporary work. The gig economy offers plenty of options, many of which require minimal startup time or investment.

Popular short-term income options include:

- Freelancing: Utilize your skills in writing, design, programming, or virtual assistance.

- Online Selling: Declutter your home and sell unwanted items on online marketplaces.

- Gig Apps: Participate in food delivery, ridesharing, or other task-based apps.

Diversifying income streams is not only helpful during financial downturns but can also provide long-term security and flexibility.

Tapping Into Emergency Funds

An emergency fund is a financial cushion specifically designed for unexpected expenses. If you have one in place, now is the time to utilize it wisely.

Best Practices for Using Emergency Funds:

- Avoid Draining It Completely: Aim to preserve at least part of the fund to handle future emergencies.

- Replenish as Soon as Possible: Set a timeline to rebuild the fund once your immediate crisis is over.

If you don’t have an emergency fund, consider creating one once your financial situation improves. Start small—even setting aside $10-$20 per week can add up over time.

Exploring External Financial Resources

In some situations, external financial assistance may be necessary. While this should be approached cautiously, there are options designed to help individuals facing short-term cash shortages. One such resource includes payday loans, which provide immediate funds to cover urgent expenses. However, it’s important to understand the repayment terms and associated costs to avoid long-term financial strain.

Other options to consider include:

- Borrowing From Family or Friends: This can be a low-cost alternative, but be sure to maintain clear communication and a repayment plan.

- Community Assistance Programs: Nonprofits or local organizations may offer short-term financial relief for essentials like housing or utilities.

Negotiating With Creditors

When faced with financial strain, it’s easy to feel overwhelmed by outstanding bills and debts. Instead of ignoring them, take a proactive approach by contacting creditors to discuss potential solutions.

How to Negotiate:

- Be Transparent: Explain your situation and the reasons for your temporary hardship.

- Request Extensions or Reduced Payments: Many creditors offer hardship programs that allow you to temporarily lower or defer payments.

- Avoid Default: Maintaining communication can prevent accounts from being sent to collections or damaging your credit score.

Creditors are often willing to work with individuals who show good faith in resolving their obligations, so don’t hesitate to reach out.

Building Long-Term Resilience

Once you’ve addressed your immediate needs, it’s essential to develop habits and strategies that prevent future financial crises. Long-term resilience requires a combination of disciplined saving, smart spending, and continuous financial education.

Key Steps to Build Financial Resilience:

- Create an Emergency Fund: As mentioned earlier, having a dedicated savings account for emergencies is critical.

- Automate Savings: Set up automatic transfers to a savings account to ensure consistent contributions.

- Diversify Income Sources: Continue exploring side hustles or investments to create a financial buffer.

- Review and Adjust Your Budget Regularly: Financial plans aren’t static—review them periodically to accommodate life changes.

By integrating these practices, you can safeguard yourself against future cash shortages while improving your overall financial well-being.

The Psychological Aspect of Financial Stress

Beyond the numbers, financial difficulties can take a significant toll on mental health. Feelings of anxiety, shame, or guilt often accompany money problems, making it harder to focus on solutions.

Managing Financial Stress:

- Acknowledge Your Emotions: It’s normal to feel stressed, but don’t let it paralyze you.

- Seek Support: Talking to trusted friends or family members can provide emotional relief and practical advice.

- Take Small, Actionable Steps: Focus on one task at a time to avoid feeling overwhelmed.

Recognizing the emotional component of financial challenges allows you to address them holistically, ensuring both your finances and mental well-being improve over time.

Conclusion: A Holistic Approach to Financial Recovery

Financial setbacks, while stressful, are often temporary and manageable with the right approach. By addressing the root cause, reevaluating your budget, exploring income opportunities, and utilizing available resources, you can regain control over your financial situation. Moreover, building long-term resilience ensures that future emergencies don’t derail your progress.

Remember, financial recovery isn’t linear, but persistence and smart decision-making will lead you back on track.