Investing can be daunting for anyone, but women investors often face unique challenges that make it even more difficult. Studies have shown that women tend to have longer lifespans than men, lower salaries, and higher expenses due to caregiving responsibilities. This makes it crucial for women to invest their money wisely to ensure a secure financial future.

Portfolio Management Services (PMS) can be an effective solution for women investors looking to build and manage their investment portfolios. PMS involves a professional investment manager who provides customized investment solutions based on the investor’s risk tolerance, financial goals, and investment horizon. The service is designed to help investors achieve their financial objectives while managing risk.

Here are some of the benefits of PMS for women investors:

- Customized Investment Solutions PMS providers offer customized investment solutions tailored to each investor’s individual needs. This means that women investors can get a portfolio designed specifically for their financial goals, risk tolerance, and investment horizon. The investment manager will work closely with investors to understand their needs and preferences before creating a personalised investment strategy.

- Professional Management PMS providers employ professional investment managers with years of experience managing portfolios. These managers use their expertise to make informed investment decisions and manage risk. They stay current on market trends and adjust the portfolio to meet the investor’s financial goals.

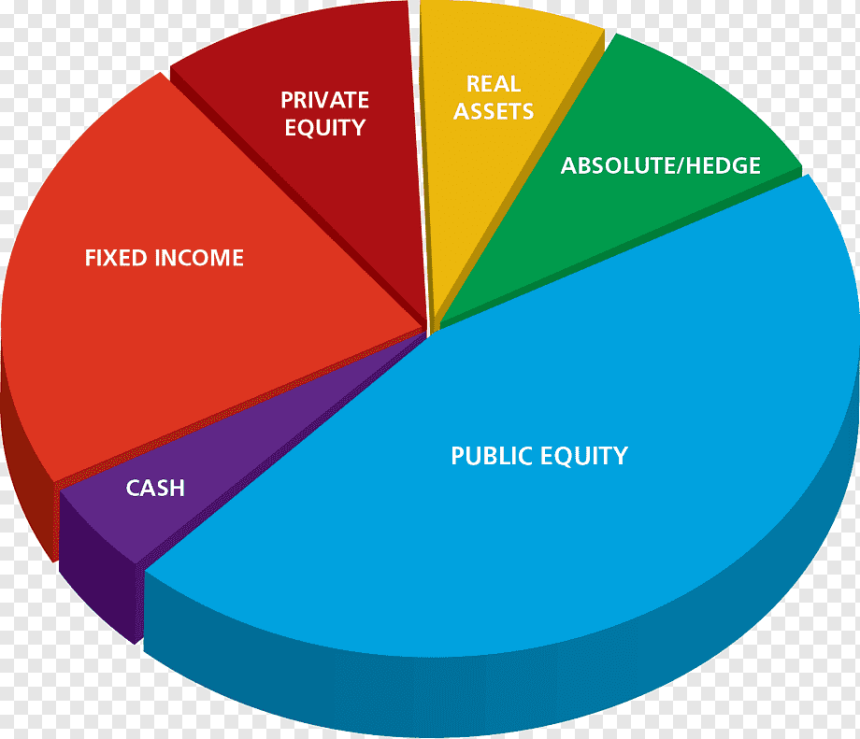

- Diversification is a key strategy in managing risk in an investment portfolio. PMS providers create diversified portfolios that include a mix of asset classes such as stocks, bonds, and alternative investments. This diversification helps to spread risk and reduce the impact of any single investment on the portfolio.

- Regular Monitoring and Reporting PMS providers monitor the portfolio regularly and provide reports to the investor on the portfolio’s performance. This allows investors to stay informed about their investments and make informed decisions about any changes they want.

- Access to Alternative Investments PMS providers offers access to alternative investments such as private equity, hedge funds, and real estate investments. These investments are typically unavailable to individual investors and can provide diversification and potentially higher returns.

- Reduced Stress and Time Commitment Investing can be stressful and time-consuming, especially for those new to investing. PMS providers take on the responsibility of managing the portfolio, reducing the stress and time commitment for the investor.

- Better Returns PMS providers use their expertise to make informed investment decisions, which can result in better returns for the investor. They also have access to research and analysis tools that individual investors may not have access to, allowing them to make more informed investment decisions.

In conclusion, PMS can be an effective solution for women investors looking to build and manage their investment portfolios. It provides:

● Customized investment solutions.

● Professional management.

● Diversification.

● Regular monitoring and reporting.

● Access to alternative investments.

● Reduced stress and time commitment.

● Potentially better returns.

Women investors should consider PMS as a way to achieve their financial goals and secure their financial future.