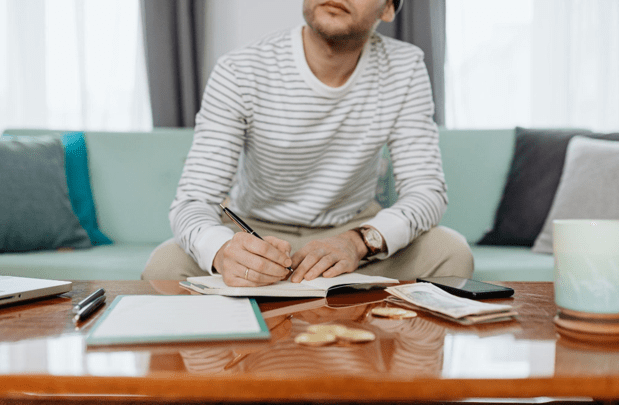

The economic weather is always hard to predict, no matter how careful you spend your money. Certain events, like healthcare problems or repairs, require an immediate big load of cash at hand, disrupting budget plans for many.

Enter the online payday loans, a quick solution for monetary emergencies before payday. These loans have helped a lot of working-class Canadians in need by approving applications as fast as under an hour and providing cash in two days maximum.

If you’re wondering why it sounds too good to be true, keep reading to know more regarding payday loans and what you need to consider as first-time borrowers.

Understanding Payday Loans

Payday loans are short-term credit that lets borrowers get fast access to money without waiting for the next paycheck. These loans usually cater to borrowers who quickly require cash for urgent needs. They come with high-interest rates and fees, especially from established lenders, to ensure that a borrower pays back, usually by the next paycheck.

Things to Consider

Before looking for a lending company in your area, consider the following factors for first-time borrowers:

The Basic Criteria

Online payday loans may be quick on lending money, but they’re strict to whom they grant the loan. These are the essential criteria that you need to meet before borrowing:

- Age 18 years old minimum

- Employed

- No unstable bank accounts

- No reports of bounced checks

- Monthly income that equals or exceeds the loan

The Money You Need

Because short-term loans have a pricey interest rate, you should only borrow the amount you need. Use payday loans if you need cash immediately for urgent matters and not for other miscellaneous expenses to keep the interest manageable. High fees and interest rates are one of the leading causes of debt traps for many borrowers.

Your Financial Situation

Always apply for a loan you know you can pay. Establish a repayment plan right before you apply for a loan. Calculate how much of your upcoming salary will go to repayment and how you will live off while waiting to offset the budget lost in the next payout.

Understand the Terms and Conditions

Do you always skip the Terms and Conditions? With lending money, sift through the entire document. As a customer, you should avail a service that you feel comfortable with, even if that’s asking for an emergency fund. Remember, you’re not required to do anything that you’re not supposed to. And by understanding the Terms and Conditions, you will know just how transparent the company is during the whole process.

Get to Know the Process

Online payday loans are faster compared to any offline lenders. The application is fast and can get approved in minutes. Still, you need to understand all the necessary know-how of borrowing money online so that you don’t miss a step or unnecessarily worry about the process.

Borrow Smartly and With the Right Partner

Always expect a bump in the road while you handle your finances. Emergencies happen that may challenge your savings and your financial plans. Thankfully, reliable companies offer online payday loans across Canada, from British Columbia and beyond, to help people address financial emergencies quickly.

With proper calculation, smart spending, and the help of online payday loans, you can easily take care of sudden financial challenges and get back to your financial plan with no sweat.