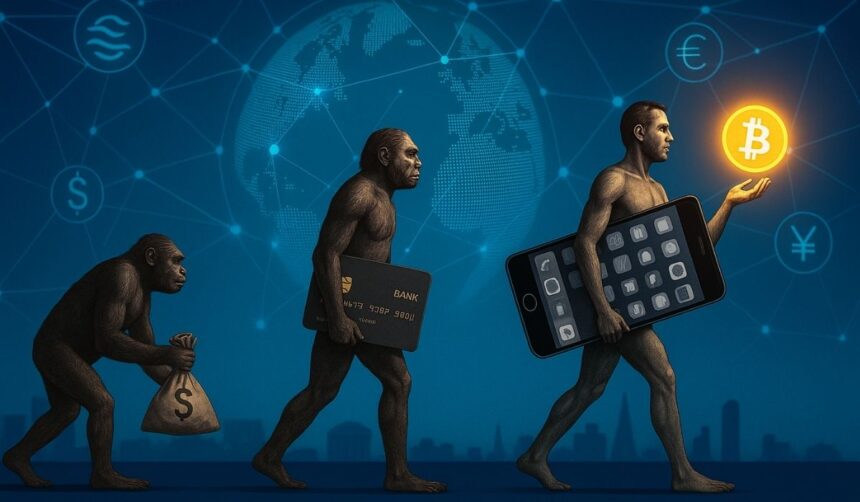

For over a decade, the idea of cryptocurrency reshaping financial systems has moved from internet forums to government hearings. What started as a conversation around decentralization is now a topic of formal legislation, with countries drafting policies on stablecoins and digital assets. As the U.S. Senate advances bills like the GENIUS Act, and financial giants begin aligning themselves with on-chain assets, it’s hard to ignore the shift.

Still, the core question lingers in both public and professional circles: Is cryptocurrency the future? Whether it’s Bitcoin being compared to gold or Ethereum’s growing ties to institutional strategies, the global monetary landscape is undeniably changing, though not everyone agrees on how far, or fast, it will go.

The Evolving Role of Cryptocurrency

From Peer-to-Peer Cash to Store of Value

Bitcoin was introduced as an alternative to traditional money, a decentralized way to transact without reliance on a central bank. But as adoption grew, so did its function. Instead of becoming everyday money, it evolved into something more symbolic. For many, it is now treated like a modern form of gold. Fixed in supply, open-source, and outside direct government control, it became a store of value rather than a method of exchange.

One of the main reasons for this shift is volatility. Daily price swings make it difficult to use Bitcoin for groceries or transport. Even stable economies find it hard to accept it as a medium for consistent payments. On the institutional side, there’s growing attention on Ethereum. Although Ethereum ETFs remain under review in the U.S., movements by large financial entities, such as notable ETH wallet activity tied to firms like BlackRock, suggest that integration may already be underway in preparation for a green light.

Cryptocurrency in Economically Fragile Nations

While debates in developed markets focus on investment value, other regions view cryptocurrency differently. In countries facing hyperinflation or political instability, digital assets offer something traditional banks cannot access. For people in places where savings are often wiped out overnight by devaluation or capital controls, Bitcoin and stablecoins are more than speculative tools. They act as a form of escape.

Cryptocurrency may not be the future of payments in cities like London or New York, but in Venezuela or Nigeria, it might already be the future of savings. This uneven adoption reflects crypto’s unique position, not as a single solution for all economies, but as a flexible tool shaped by local needs.

Stablecoins and the New Age of Digital Money

GENIUS Act: The U.S. Signals a Turning Point

One of the clearest indicators of cryptocurrency’s shift from experimental to systemic is the recent legislative momentum around stablecoins. The GENIUS Act, passed by the U.S. Senate, outlines how stablecoin issuers should operate under federal oversight. It’s the first sign that policymakers are preparing for a hybrid future, one where fiat and crypto-based currencies might run alongside each other.

Corporate entities are adapting fast. Ripple, known for its focus on cross-border finance, is preparing its own stablecoin. This move represents more than just innovation, it’s positioning. These developments suggest that stablecoins may soon power a more efficient, possibly cheaper system for international money movement, challenging the pace and cost structure of older remittance systems.

Are CBDCs a Threat or an Ally?

The rise of government-issued digital currencies adds another layer to the discussion. China’s digital yuan is already active in select regions, while the U.S. continues to explore its own version of a central bank digital currency. These tools offer digital functionality but remain under centralized control, unlike crypto. Whether the two systems will clash or complement each other remains unclear.

However, the trajectory suggests they’ll likely coexist. Stablecoins might fill the gap for global payments and programmable finance, while CBDCs will handle domestic policy needs. The two aren’t built for the same purpose. Crypto was designed to operate without permission. CBDCs, on the other hand, are structured with full compliance at their core.

Crypto Beyond Currency: The Asset Class of the Future

ETFs, Tokenization, and the Rise of “Smart Money”

With Bitcoin ETFs now available to retail and institutional investors, cryptocurrency has entered the broader investment mainstream. These ETFs allow people to engage with digital assets through familiar financial infrastructure. Ethereum-based products are still pending, but large investors are already moving in anticipation, adjusting portfolios to account for eventual regulatory approval.

Tokenization is another trend gaining traction. Assets like property, bonds, and even equity are being represented as digital tokens, allowing fractional ownership and faster liquidity. NFTs, once dismissed as speculative collectibles, are evolving into rights management tools, with use cases in media, legal agreements, and asset tracking.

Some of the more advanced ideas go further. In one lecture, Columbia professor Farrokhnia introduced the idea of “self-driving money”, a future where funds manage themselves automatically based on preset conditions. While still early, these concepts hint at how crypto infrastructure could be used to reduce friction in everyday finance.

What Investors Need to Consider

The price swings that first attracted speculators are still present. For most investors, this creates hesitation. But volatility alone doesn’t rule out value. It only requires a different perspective. Long-term holders, for example, tend to view crypto not as a daily trade but as a hedge, or a potential growth vehicle that sits outside traditional risk models.

Research from Crypto Analysts shows how investment behavior has shifted from meme-driven bursts to structured products, index-style exposure, and fund-level analysis. There’s no single way to approach it, but the market is maturing.

Rethinking the Role of Money and Access

One often-overlooked angle in the debate around cryptocurrency the future is its relationship with access, not just financial, but geographic and social. In regions where citizens struggle to keep up with inflation or face restrictive capital controls, crypto has been a workaround, offering a way to preserve value and conduct transactions outside broken banking systems. Here, cryptocurrency is not an abstract investment or a novelty. It is a tool for survival.

At the same time, the broader industry is beginning to question how financial services are built. Concepts like “self-driving money”, where savings and investments are automatically managed based on user goals, are no longer theoretical. With the combination of blockchain, automation, and financial modeling, it’s possible to imagine systems where the user is less burdened with technical complexity and more supported by intelligent design.

Yet this shift brings its own set of concerns. Automation may reduce manual errors, but it also increases reliance on code and algorithms. Privacy, data control, and algorithmic bias are becoming central to the next phase of the crypto-fintech evolution. These challenges aren’t unique to crypto, but they must be addressed if this space is to provide value beyond niche markets.

Final Thoughts: A Layer, Not a Replacement

Cryptocurrency may not be the future of all finance, but it’s clearly becoming a part of it. It’s not about whether it will replace fiat – most likely, it won’t. But from stablecoins in regulated systems to digital gold narratives in volatile economies, the shape of money is shifting. Financial tools are being rebuilt from the ground up, influenced by code rather than policy alone.

For now, the idea of cryptocurrency the future isn’t about total replacement, it’s about integration. It is showing up in portfolios, in remittance rails, and in the strategies of companies preparing for what’s next. Not everything has settled, and many questions remain. But one thing is harder to deny: the role of crypto in finance is no longer a debate about potential, it’s a reflection of where the world is already headed.