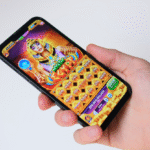

Let’s be honest — fintech doesn’t look like finance anymore. It’s no longer just apps that show your balance or process transfers. Some platforms hand out tokens. Others let users predict market changes or earn digital rewards. The whole thing feels a bit like a game, only with real outcomes.

And here’s where it gets interesting: licensing. In places like Comoros, some of these startups aren’t registering as banks or financial entities. Instead, they’re using a Gambling license in Comoros. The same kind once meant for digital poker sites is now giving legal footing to blockchain projects, staking tools, and crypto-based prediction platforms. Sounds odd, but it’s becoming more common than most people think.

Why This Workaround Exists

Many fintech apps today aren’t banks. They don’t take deposits, issue credit, or manage portfolios. They offer interactions — maybe guessing how a token will move, maybe rewarding a user for logging in every day. There’s risk, there’s value — but it’s wrapped in a layer of gamification.

Now, most regulators aren’t ready for this. If you’re not clearly a financial institution, and not clearly entertainment, you often get stuck. Some founders wait for licenses that never come. Others go looking for alternative paths — like in Comoros.

What Comoros Offers

In Comoros, the gambling license isn’t just for casinos. It covers platforms with games of chance or skill — and that’s the loophole. If your product lets users interact with uncertain outcomes, you might qualify. You don’t need millions in capital. You don’t need years of compliance. You just apply, and if approved, you go live.

It’s not magic. It’s just more open. And for early-stage projects trying to test and iterate, that makes a real difference.

Who Uses It

Not big banks. Not even mid-sized payment platforms. But crypto tools? Reward apps? Prediction engines where tokens flow? Absolutely.

Think:

- Platforms that give you points for predicting Bitcoin trends

- Apps where users stake coins and unlock achievements

- Games that aren’t quite games, but still involve risk and payouts

These aren’t regulated financial products. But they’re not just games either.

The Good Side

Let’s list what this model offers:

- Speed — You can be up and running in weeks, not quarters

- Flexibility — You don’t need to fit into old regulatory shapes

- Affordability — No massive compliance department needed

This kind of freedom gives teams breathing room. Instead of chasing licenses for years, they can ship, learn, and — if needed — pivot.

And the Downsides

Of course, there are trade-offs.

- Some payment providers won’t work with anything labeled “gambling”

- Users may get the wrong idea, especially in certain regions

- If your app scales, you might outgrow the license faster than you think

Plus, there’s always the risk of perception. A platform offering financial behavior under a gambling umbrella might raise questions — even if it’s technically legal.

Why Emerging Markets Go First

Markets like Comoros don’t have a massive regulatory legacy. They don’t have ten agencies fighting over who regulates what. That gives them freedom. And for them, offering flexible licensing is a win — it brings in revenue, attention, and startups that would otherwise go underground.

They’re not ignoring risk. They’re choosing to support innovation, even if the lines aren’t perfectly drawn yet.

What Comes Next

Eventually, bigger markets will follow — not by copying Comoros, but by creating new categories of licenses that reflect how people actually use fintech now. Until that happens, early movers will keep using tools that weren’t built for them, but that work well enough to get started.

And for many of these hybrid platforms, that’s what they need: a place to begin.

Final Thought

When the tech moves faster than the rules, founders improvise. The Gambling license in Comoros is one of those improvisations — not ideal, not permanent, but functional.

And in a world where ideas are easy and compliance is slow, functional often beats perfect.