Business owners often have to deal with multiple critical tasks when they are at the beginning of their entrepreneurial journey. That’s the period when the company can’t afford to hire a dedicated accountant or buy expensive software. Thus, employers must consider ways to cut their expenses while not endangering the possibility of growing their businesses.

A paystub creator offers an opportunity to cut expenses while not harming your ability to focus on other tasks. It’s a generator tool that enables you to create a pay stub without spending days completing this task. But what is a pay stub, and why is it so important? This article covers necessary details about the pay stubs and why you, as an employer, must provide them to your employees.

What Is A Pay Stub? What Data Does It Contain?

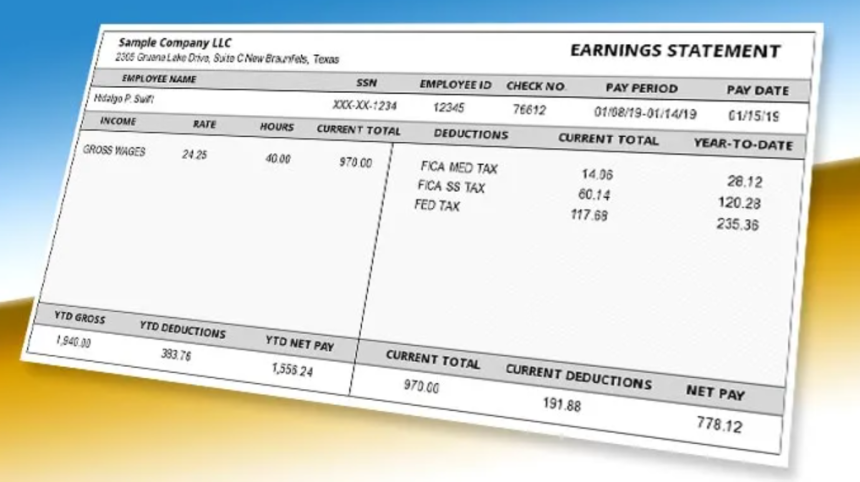

A pay stub is a financial document that reveals the data about an employee’s compensation for their work (a person’s salary). They are called pay or check stubs or slips. Check slips reflect an employee’s total earnings for a certain pay period. This includes gross income, hourly rate, premiums, and even tips. Pay stubs also include itemized tax withholdings, such as FICA taxes, and deductions for things such as health insurance premiums and employer-sponsored retirement plans.

A pay stub acts as an employer’s payment receipt. It also keeps track of how much money was deducted from each employee’s paycheck and for what purpose. Pay stubs were originally tied to employees’ physical paychecks, which is how they received their names. Pay stubs are now often sent digitally and are available online for download when needed for firms who utilize a paperless payroll or a payroll provider.

A pay stub can be formatted in a variety of ways. You have the freedom to select a template that works for you. Ensure the details are as well ordered as possible to make the statement easy to understand. Here’s the information typically included on the pay slip:

- Information in general. This section always contains the company’s name and address, the employees’ names and addresses, and their Social Security and ID numbers. Additional data may include the pay period’s date range and when the employee receives the salary.

- Gross wage. This section details an employee’s gross earnings before taxes and other deductions. It contains the hourly rate, overtime pay, bonuses, sick pay, etc. It also concludes the overall earnings, called gross income before taxes.

- Deductions. This section includes all standard deductions and a few withholdings that may be individual in every case. They also depend on the state the company operates in and other factors.

- Net income. This section indicates how much an employee receives as a salary or wage after all withholdings and deductions.

Sometimes, employers also indicate what contributions they make. It’s not a requirement but offers transparency, and employees understand their rights.

Why Are Pay Stubs Important?

Pay stubs are less important to employers, and some even consider them a waste of time. However, company owners should understand that they, too, benefit from creating pay slips. One of the main reasons to create them is for easy tax season preparation. Instead of wasting time calculating how much you paid each employee to use these calculations to reduce your tax burden, you can use your records and save time.

Moreover, pay stubs are highly beneficial for employees. They might trust you more if you disclose the information behind calculating their salaries. But the main reason employees benefit from pay slips is that they use these documents as proof of income when applying for a loan or a mortgage.

What Is A Paystub Creator?

Check stubs, or pay stubs, are documents that employees receive from their employers. If the person is self-employed, they can create pay stubs for themselves. The document includes such critical data as the salary or wage, company and employee names and addresses, withholdings, tax deductions, and other data.

Generating these pay stubs is the tax of an employer (or a self-employed person). However, how do they create these documents? They use a paystub creator software or tool. It’s a software-based program offering hundreds, if not thousands, of templates. Some of these templates are customizable so that companies can add their logos, contacts, etc.

These generators save time and cut costs for small and mid-sized businesses. Instead of buying expensive subscriptions for accounting software, you can use cheaper and more effective generators. Check out a standard instruction on using an average paystub creator tool below.

How To Create A Paystub?

The guidelines differ from service to service. However, there are a few things in common. Here’s how to generate a pay stub:

- Insert information about the firm, employees, and their earnings.

- Fill in any appropriate deductions and premiums.

- Choose the “Generate” or “Create” option.

Check your email. The pay stub is prepared and ready for you. Typically, these services require you to create an account.

Final Thoughts

So, a pay stub is a document that indicates how an employer calculates an employee’s salary. It’s not a paycheck since you can’t use a pay stub to receive a salary. A pay stub serves a different purpose. Employers can use these pay stubs during the tax preparation season to calculate deductions from their taxable income.

Employees may use this document to understand how much taxes they pay, what benefits they are entitled to, etc. Moreover, they may use pay stubs as a way to prove their income. This is often needed when applying for a bank loan or a mortgage.

Employers are not required by federal law to create these check stubs. However, it’s still recommended to do so for a variety of reasons, one being the easier preparation for filing taxes. Moreover, most states still require companies to provide employee pay stubs. Companies may cut their expenses and time spent on these documents by using convenient generators. Hopefully, this article has all your answers about pay stubs, what they should include, and how to create them.