Introduction to Digital ID Verification

In a digital world that is changing quickly, the requirement for efficient yet secure identity verification systems has never been more crucial. Digital ID verification is at the heart of this transformation, playing a critical role in electronic Know Your Customer (KYC) processes. Ensuring the integrity of digital identities helps combat fraud and streamlines customer onboarding, making it a win-win for businesses and consumers. Several digital ID verification companies provide comprehensive services for businesses looking to adopt such solutions to ensure a seamless transition. These solutions are adaptable to various industries, from banking to healthcare, making the technology incredibly versatile and indispensable for modern-day digital operations.

- Introduction to Digital ID Verification

- Why eKYC Processes are Essential

- How Digital ID Verification Works

- Benefits of Implementing Digital ID Verification

- Common Challenges and Solutions

- Data Privacy and Security

- System Integration

- Real-Life Applications and Success Stories

- Future Trends in Digital ID Verification

Why eKYC Processes are Essential

KYC processes are indispensable for several reasons:

- They ensure compliance with ever-stringent regulatory requirements that different industries must adhere to. By implementing eKYC, organizations can avoid hefty fines and maintain their reputations.

- These processes are vital in the fight against fraud. By verifying customer identities at the onset, businesses can effectively minimize fraudulent activities and secure their operations.

- eKYC greatly enhances customer convenience and satisfaction.

Instant verification minimizes wait times and provides a smoother onboarding experience, boosting customer trust and loyalty.

- Compliance with regulatory requirements

- Minimizing fraud and enhancing security

- Improving customer convenience and satisfaction

How Digital ID Verification Works

The digital ID verification process typically involves three main steps. The first step is data collection, where essential identity data such as documentation (passports, driver’s licenses) and biometrics (fingerprints, facial recognition) are gathered. This data is sourced from the customers and stored securely. Next is the verification stage, where the collected data is cross-referenced with authoritative databases. This could involve checking government databases, financial records, or even third-party verification services to confirm the identity’s authenticity. Finally, the authentication step ensures that the person presenting the ID is who they claim to be, often involving multi-factor authentication methods to provide an additional layer of security.

- Data Collection: Gathering essential identity data such as documents and biometrics.

- Verification: Cross-referencing collected data with authoritative databases.

- Authentication: Ensuring the validity of the identity being presented.

Benefits of Implementing Digital ID Verification

Implementing digital ID verification within eKYC processes brings a multitude of benefits. It not only reduces fraud but also enhances customer trust. Fraudulent activities can cause businesses significant financial and reputational damage, but robust ID verification systems help mitigate these risks effectively. As companies aim to provide streamlined digital experiences, this technology becomes indispensable. Furthermore, digital ID verification helps in building stronger customer relationships. Consumers are more inclined to believe businesses are committed to secure practices, leading to increased customer loyalty and long-term business growth.

Common Challenges and Solutions

Data Privacy and Security

One of the main challenges in digital ID verification is ensuring data privacy and security. Organizations must adopt robust encryption methods and compliance measures to safeguard sensitive information. Using end-to-end encryption and multi-factor authentication are some practices that can mitigate these concerns. Additionally, companies must remain vigilant about regulatory changes and be prepared to update their systems accordingly. Regular audits and security assessments can also maintain the integrity of the verification processes, ensuring that any vulnerabilities are promptly addressed.

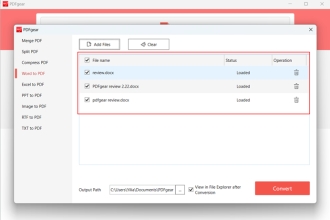

System Integration

The integration with existing systems and workflows can also pose a challenge. Adopting API-based solutions and a modular approach can significantly ease this process. Ensuring the system is flexible and scalable to future technological advancements is crucial for long-term success. Seamless integration is critical to maintaining operational efficiency while adopting new technologies. Companies should also focus on employee training to ensure the staff is well-equipped to handle new systems, thereby minimizing disruptions during the transition phase.

Real-Life Applications and Success Stories

Industries worldwide are leveraging digital ID verification to enhance their processes. For instance, the banking sector uses this technology for secure customer onboarding, where the danger of fraud can be decreased by instantly verifying new account users. The healthcare industry also benefits significantly, with digital ID verification used to protect patient information during telehealth consultations. These technologies ensure that sensitive medical data is accessed only by authorized individuals, enhancing patient trust. These success stories underscore the technology’s versatility and impact across different sectors, showcasing its potential to revolutionize various industries.

Future Trends in Digital ID Verification

Artificial intelligence and biometrics advancements are transforming digital ID verification, enhancing security and efficiency. AI-driven algorithms can process and verify identities faster and more accurately than human operators, reducing errors. Decentralized identity and blockchain integration are also gaining traction, revolutionizing eKYC processes. Decentralized identity allows users to control their data, while blockchain ensures tamper-proof data. As these technologies evolve, digital ID verification becomes an essential tool for businesses worldwide.