As businesses today operate in a digital world, embracing the power of plastic is essential to success. It can reduce costs, increase customer efficiencies, give companies access to more targeted marketing opportunities, and improve security and fraud prevention measures.

- What Is Plastic Money and How Does It Work for Businesses

- Types of Plastic Money and How to Choose the Right Card Payment System

- Advantages of Accepting Credit Cards and Other Forms of Plastic Money

- Tips on Optimizing Credit Card Payments for Maximum Efficiency

- Analyzing Trends in Card Payments – What’s Working, What’s Not

By leveraging card payments — whether debit or credit — businesses can gain greater control over finances while maximizing customer satisfaction with faster checkout times, lower fees, and rewards programs. In this article, we’ll explore how investing in card payment technology can strategically position your business for long-term growth. We’ll also provide tips on selecting the right provider or merchant services solution. So let’s get started.

What Is Plastic Money and How Does It Work for Businesses

In today’s digital age, businesses continually look for new ways to conduct financial transactions. One such method that has gained popularity is plastic money, also known as credit or debit cards. Plastic money replaces cash transactions and allows businesses to accept payments electronically. This payment method works by allowing customers to pay for their purchases using a card, which is linked to their bank account.

When customers pay, the funds are transferred electronically from their account to the business’s account. Plastic money offers businesses a convenient way to process transactions quickly and securely, which is why it has become an essential tool for many modern businesses. ACH payment solutions, for example, can easily be integrated into a business’s existing payment systems, making it a seamless process for both parties involved.

Types of Plastic Money and How to Choose the Right Card Payment System

There are two main types of plastic money – debit cards and credit cards. Debit cards allow customers to access funds directly from their bank account, while credit cards allow them to borrow money up to a specific limit. Both types of card payments have their advantages for businesses, and choosing the right payment system is essential for your business needs.

For small businesses, debit cards may be the preferred choice as they typically have lower transaction fees and can help with better cash flow management. Credit cards are more suitable for larger businesses that require higher credit limits and can handle potential risks associated with borrowing money.

When choosing a card payment system, it’s also essential to consider factors such as security features, customer service support, and the ability to accept payments online or in person. Choosing a provider that offers reliable, secure, and user-friendly solutions for your business is crucial.

Advantages of Accepting Credit Cards and Other Forms of Plastic Money

Accepting credit cards and other forms of plastic money can bring numerous benefits to businesses. In addition to the convenience for customers, it also offers a variety of advantages that can help drive business growth.

One significant advantage is increased sales. By offering card payments, businesses can expand their customer base by catering to those who prefer electronic transactions over cash or checks. It brings in more customers and encourages repeat business by providing a convenient and hassle-free payment experience.

Card payments also offer improved cash flow management for businesses. As funds are transferred electronically, companies can expect faster access to their money than traditional check or cash transactions. It allows for better planning and management of finances.

Another significant advantage is the ability to track purchases and customer data. With card payments, businesses can easily collect data and gain insights into consumer spending patterns, allowing for more targeted marketing strategies. It also enables companies to offer rewards programs or other incentives to customers, further increasing customer satisfaction and loyalty.

Tips on Optimizing Credit Card Payments for Maximum Efficiency

Credit card payments represent a necessary part of most people’s monthly expenses. However, they can quickly become overwhelming, especially if you carry multiple cards or need help to make payments promptly. Optimizing your credit card payments for maximum efficiency in today’s fast-paced world can make all the difference in your financial well-being.

By following simple tips, such as automating your payments, creating a payment calendar, and taking advantage of rewards programs, you can ensure that your credit card payments are working for you instead of against you. So why wait? Start optimizing your payments today and see how easy it can be to manage your finances like a pro.

Analyzing Trends in Card Payments – What’s Working, What’s Not

As technology advances, the card payments world is constantly evolving. Businesses must stay current with trends to remain competitive and meet customer expectations.

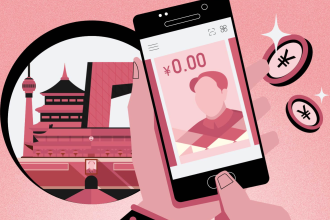

One trend gaining popularity is contactless payment options, such as Apple Pay or Google Pay. These allow customers to make transactions quickly and securely using their mobile devices without needing a physical card. Businesses that offer these options can cater to the growing number of customers who prefer this payment method. Another trend is the rise of digital wallets, which store multiple card details and allow for easy and secure online transactions. It can be especially beneficial for businesses that primarily operate online.

On the other hand, traditional methods such as checks or cash payments are gradually becoming less popular as consumers opt for more convenient and secure options. Businesses relying solely on these methods may risk losing customers who expect quicker and easier payment methods.