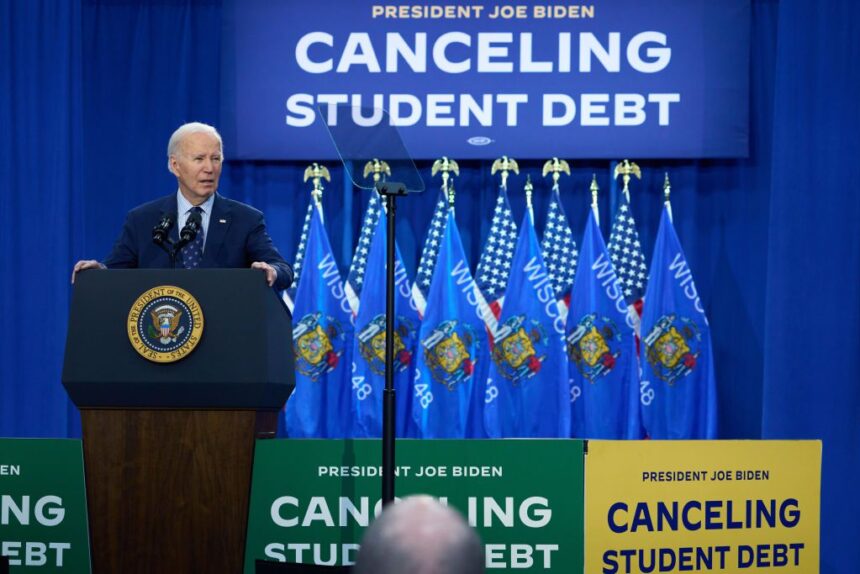

The Supreme Court may overturn President Joe Biden’s policies after three states petitioned the highest court to strike down his student debt relief plan.

Alaska, Texas, and South Carolina filed a lawsuit on Tuesday, requesting the Supreme Court reverse an earlier ruling by the 10th US Circuit Court of Appeals that had approved the continuation of much of Biden’s student loan plan.

Roughly 3 million Americans may receive a rise in their monthly payment under the Saving on a Valuable Education Plan if the states get their way. Eight million Americans are registered in the SAVE Plan, of which three million expect to see reduced payments this month as the program is fully implemented.

The states claim in the filing that the current plan is “every bit as unlawful” as the president’s first large-scale student loan forgiveness program. That one was eventually overturned by the Supreme Court, despite its intention to free millions of Americans from debt.

The states stated in their filing that “the Court must unfortunately step in again due to the Administration’s intransigence.”

In June, several federal judges ruled against Biden’s income-based repayment program, Saving on a Valuable Education (SAVE).

Millions of federal borrowers witnessed a reduced monthly payment under the SAVE, sometimes to zero.

According to the Education Department, the SAVE Plan has canceled $5.5 billion in federal student debt for over 400,000 borrowers. The courts’ orders will not affect this, but they did prevent the Education Department from advancing the SAVE program.

However, it’s uncertain how SAVE will perform in the upcoming months, as the 10th US Circuit Court of Appeals postponed one of these decisions.

Michael Lux, an attorney and the founder of Student Loan Sherpa, told the media, “I think there is a realistic possibility that both provisions will ultimately be struck down.” “Both district court judges were Obama-era appointees, so these are experienced judges and the injunctions don’t look like politically motivated decisions. It is also worth noting that judges don’t usually grant an injunction unless the plaintiff is likely to succeed on the merits.”

The three states express concerns about the hundreds of billions SAVE will cost the public. Still, Biden’s administration claims that more than 20 million borrowers will be assisted if it goes forward.

According to Alex Beene, a financial literacy instructor at the University of Tennessee at Martin, “These three states are making the argument, which is a financially fair one, that this type of loan forgiveness does have some legal hurdles that are difficult to overcome and long term will cost taxpayers, including those who didn’t take out student loans, millions of dollars.”

“The Biden Administration’s plan to lower monthly student loan payments seemed like a popular and sustainable one for borrowers in the short term, yet the long-term promises of potentially forgiving those loans entirely at a future date are where many take cautions.”

Beene stated that if the plans are ultimately reversed, there should be uniformity across the country regarding the federal government’s authority and limitations with regard to student debt.

“The on-again-off-again policy occurring now causes more confusion and inability to plan for other financial plans borrowers may have,” Beene added.

Lux stated that the entire legal procedure has been “terribly frustrating” for borrowers. However, he added that for the time being, debtors must hope that every SAVE provision passes judicial review. Any additional loan forgiveness is doubtful if it doesn’t.

“We’ve dealt with weeks of abrupt changes, gotten little clarity, and more changes are likely ahead,” Lux stated. “The judicial whiplash makes it really hard to plan a repayment strategy and puts responsible borrowers in a bind.”