Federal R&D tax credits greatly benefit large and small companies in almost any field or industry. This article will attempt to answer some of the most commonly asked questions related to the R&D tax credit. Check them out below.

First things first: What is the R&D Tax Credit?

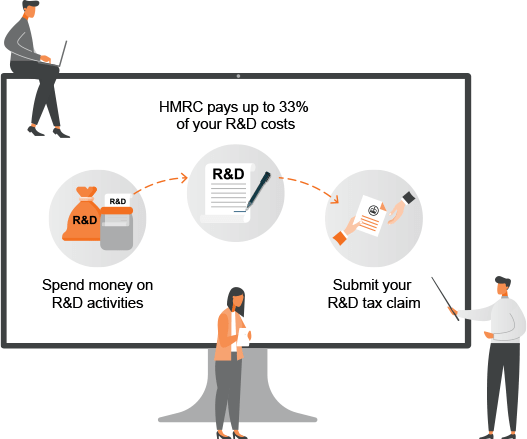

The R&D tax credit was created in 1981 to encourage research and development (R&D) in the United States. It is used to offset federal income tax liability and, in some cases, liability to payroll tax. Most states in the country has a similar credit, which makes the federal and state credits’ average potential benefit within the 10-20% range of qualified spending. Around $18 billion in R&D credits were reported by businesses in most industries last year.

The R&D tax credit is also known as the “R&E credit”, “R&D Credit”, “Research and Experimentation Credit”, or simply “research credit”. It equals the sum of amounts computed using two different kinds of expenses”

- Qualified Research Expenses (QREs)

- Basic Research Payments (BRPs)

In general, both expense types refer to activities done in the U.S. to improve U.S. technologies. They differ in the following ways:

| Expenses must relate to BRPs QREs |

| · Advancement of scientific knowledge and research YES NO |

| · An original research YES NO |

| · No specific commercial objective YES NO |

QREs are exactly for specific commercial purposes and they don’t have to be necessarily for original research for advancing scientific knowledge; they can be a by-product or a copy of a similar research. In addition, QREs don’t have to be done for the purpose of improving scientific knowledge; they can be for improving product and processes, or software development or improvement.

If you, your business or company has made or is making QREs or BRPs, you may qualify for R&D tax credits, regardless of whether your activities end up in success or not.

What Benefits Do You Get from R&D Tax Credit?

Companies can benefit from R&D credits in the following ways:

- It improves cash flow

- It increases earnings per share

- It increases return on investment (ROI)

- It reduces liability on federal and state tax

- Reduces effective tax rate

What Activities Qualify for R&D Credits?

Generally, a company’s activities qualify if they tick off each element of a four-par test.

Four-part Test:

- Qualified Purpose –is the purpose of the activity to improve the operations, performance, quality, or reliability of a process, product, invention, software, technique or formula that’s meant to be used in a taxpayer’s business, or is held for sale, for lease, or license?

- Technological in Nature –whether the evaluative process fails or succeeds is determined by the principles ruled by physics, engineering, biology, chemistry, computer science, or similar natural or ‘hard’ science, unlike the principles of social sciences or economics.

- Technological Uncertainty –the taxpayer is faced with doubt regarding whether it can or how it can/should develop the component or concerning the appropriate design of the component.

- Process of Experimentation –to remove any uncertainty, the taxpayer assesses other options through simulation, modeling, systematic trial and error, or other means.

Do You Have to Achieve a Major Scientific Breakthrough to Qualify for R&D Tax Credits?

The short answer is NO.

This is one misconception that has been commonly perpetuated by poorly developed administrative guidance. The good news is, after a while, the agency responsible for such poor guidance eventually realizes how such guidance is misleading and baseless.

Activities do not have to succeed to qualify for R&D credits. In general, they only have to at least try or attempt to uncover technological information or develop and/or improve a business component’s operations, performance, quality, or reliability by properly checking how it can be done.

What Activities Do Not Qualify?

There are some activities that do not qualify or are excluded because they weren’t deemed to encourage an increase in the kind of R&D the credit was intended for.

Activities that do not qualify include:

- Research done outside the U.S.

- Market research

- Management

- Routine collection of data, or ordinary testing for quality control of existing components

- Consumer preference testing

- Research financed by an unrelated third party, that is for which the taxpayer either doesn’t hold rights to the activity or necessarily have to pay for the activity as the third party is obligated to pay for it in contract, even if the activity is unable to produce satisfactory results

Other activities that don’t qualify simply because in general they do not meet the four-part test:

- Administration

- Repairs and maintenance

- Training

- Troubleshooting

- Tooling up for production

- Trial production runs

- Pre-production planning for a finished component

- Collecting data related to the production process

- Activities based on the arts, social sciences, or humanities

- Research after commercialization

- Adjusting existing components to fit a particular customer’s needs

- Copying an existing component through reverse engineering

Remember: if an activity meets the four-part test, it is likely to qualify for R&D credits. If the IRS looks into the said activity, it might require more scrutiny, but the important thing is if it meets the four-part test.

What Companies Benefit from R&D Tax Credits?

In general, any business or company regardless of size or industry, that invests in the activities described in this article can qualify, if in running a U.S. trade or business the company paid or will pay the following:

- Regular federal income tax or

- A similar state tax in one of the U.S. states providing incentives for R&D and R&D-related investments

- Federal payroll tax or

- Similar taxes in over 35 non-U.S. countries providing similar incentives

The industry doesn’t really matter in general. However, most companies that claim R&D credits are manufacturing (around 60-70% of total credits claimed), information (15-20%), professional, technical and scientific services (10-15%), wholesale and retail (5-10%), and financial and insurance (5%).

Companies in other industries including natural resources, such as oil and gas, and mining, and services also claim millions of credits each year. Size doesn’t matter—even businesses with $0 in sales and just one employee can be awarded significant amounts of R&D credits.