A dream of buying a car with credit that looks more like a nightmare is possible if you work smartly. Calculated risks with a few tweaks can make your dream of buying a car come true. Though, the interest rates will be higher for a bad credit score in comparison to good credit.

In an industry whose foundation is built on trust, lenders generally prefer to give auto loans to people who possess a good credit score to pay back their loans on time. If you do not have the leverage of good credit, the trust is compensated by a higher interest rate and more restrictions on terms.

Buying a car can actually help in reviving your bad credit. A conscious decision in buying a new or used car, that can otherwise be financial devastation can be gauged by navigating through the path of financing, maintaining, and ownership journey of popular cars like the 2021 Chevrolet Tahoe, 2021 Chevrolet Trailblazer, 2021 Mazda CX 5 and many more.

Credit Score

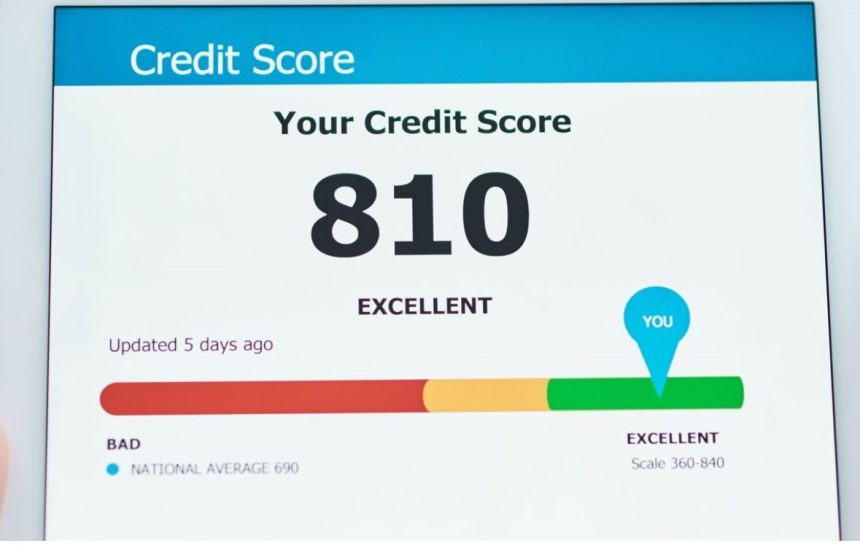

Before we go deep into the ownership journey, let us first get an overview of what a credit score is and how it can be used as leverage. A credit score is a number between 300 and 850 that reflects the credit history of an individual or organization. A lender gets an idea of your creditworthiness or in other words the repaying capacity. The score accounts for timely repayments, the amount of credit taken from time to time, the age of credit from potential lenders, and derogatory information.

Bad Credit Score

On a scale of 300 to 850, a bad credit score is considered between 300 and 579. The Fair range of 580 to 669 gives an impression that you repay most of the time. Though, the best scores are good and very good, ranging from 670 to 739 and 740 to 799 respectively. Getting a loan is much easier and cost-effective for a good and very good credit range. A score from 800 to 850 is considered exceptional. The scores are decided by the lender based on the FICO credit score model wherein scores below 670 are poor.

Why does credit score matter?

Not only does the lender decide whether to approve or decline your loan application but also sets the terms of your loan based on credit score. The terms include the amount they lend or credit limit, the interest rate charged, the down payment amount, and the length of the loan.

Talking of numbers, a super-prime new car buyer can expect to pay an overage interest of 4.01 % while a subprime borrower about 11.71 % for the same loan. The lowest in the chain can pay up to 14.30 %. The numbers show that a person with a bad credit score pays almost four times the interest rate than good credit.

An example of $20,000 used 2021 Chevy Tahoe or a 2021 Chevy Trailblazer with a 10 % down payment and a five-year loan. So, the amount of loan taken is $18,000. It is found that deep subprime buyers would have to pay over $8,000 more in interest while the subprime buyer pays $6,500 more than the excellent creditor.

Where to find your credit score and credit report?

Before you go to buy a new car, you want to check your credit score. Online sources are available to check your credit score in exchange for you to provide your personal information. A credit report can help you identify where the issues lie in case of a bad credit score. The most trusted site is AnnualCreditReport.com to provide credit reports from Equifax, Experian, and TransUnion.

Finding the car that fits your portfolio and needs

When you are having a bad credit reputation, a reset of expectations will definitely help. An ideal car would be the one that sits in the sweet spot between fulfilling needs and not busting your finances. The auto industry always tries to fulfill the dreams of buyers by crafting a financial package that can probably get you an expensive ride. But, you need to be realistic and choose a subtle car that fits your requirements. This way you can pay each repayment timely and improve your credit score. It’s best to check with an auto finance group to see what is available first and foremost.

For example, the 2021 Chevy Tahoe, 2021 Chevy Trailblazer, or other budget SUVs can be a better choice than expensive luxury SUVs like a Cadillac or Mercedes-Benz.

Shopping the best pre-approved car loan

Once you find your credit score and choose the right car that fits your needs and budget, it is time to shop for an attractive loan. It is critical to get a pre-approved loan before you go to a dealership. Though buying a car and financing it can be done in one location, it is not a good idea if you have a bad credit score.

To get your pre-approved loan with maximum benefits, it is advised to target Large National Banks, Credit Unions, Community Banks, and Finance Companies. A loan from the dealership can cost extra as they are only the middlemen between buyer and lender.

Things to look upon while selecting a Car Loan

Most lenders prey on buyers with bad credit scores so that they can charge exorbitant interest rates. They also state strict terms of seizing the car if the buyer misses even a single repayment. The more the flexibility and lower the interest, the better. But, for a poor credit score, it is advised to look for “Buy Here, Pay Here” used by dealers. This means the dealers finance their own cars. They may get you a better deal than traditional banks or finance companies.

Applying for an Auto Loan with a Poor Credit Score

Once you find the lender, it is time to formally apply for a pre-approved loan. Lengthy loan application asks questions about assets, income, liabilities, and monthly expenditure. Your social security number needs to be provided for them to access your credit score and reports.

Though, buyers with a bad credit score may be asked for more documentation than one with good credit. It is important, to be honest about the numbers you put in the form as they will be cross-checked. The first layer of trust is built here.

To get a bad credit loans deal, you should apply to several lenders but with the same loan rather than a series of loans. Once you find a lender it is advised to always negotiate terms and interest. You need to be confident with your numbers and walk the lender through your plan.

Finalize the Purchase

When you are buying a new or used car from a dealership, they take care of the paperwork. Still, you should get a clear idea of the numbers, the interest rate charged, and repayment EMIs. Some dealers try the Yo-Yo scheme in which the buyer is allowed to take the car home before the finalization of financing.

After a few days, a call comes from the dealership that something went wrong and you need to report at the dealership. Once you arrive there, a more expensive plan is presented to you. This is called a spot-financing trap. It is advised not to take the car without the paperwork being finalized to avoid a bad deal.

Buying the right Car Insurance

Nowadays, insurance is a must when buying your new car. Selecting an attractive insurance package can save you money and take care of the car’s long-term health.

There may be penalties in insurance prices due to a bad credit score but you can substantially compare schemes and select the best. The charges differ from models.

Repayments for Car Loan

Repayment on time is the most crucial step in improving your credit score substantially. If you can make every repayment in full and on time, your credit score can improve. This has a series of benefits fast-track one year later. If the score bump can push you to a higher tier of ‘Good’ or ‘Very Good’, you may re-negotiate terms and interest rates.

Refinancing your own loan can be the next smart step once you have good credit. This can take you out from astronomical interest rates. Though refinancing is much more scrutinized, you need to move smart in order to avail maximum benefits of your deeds.

Conclusion

Buying a car is now possible with a bad credit score. With smart moves and everything according to plan, you can actually get out of bad credit and enjoy the fullest of your car. The steps followed to strike a safe bet are easy and can be done artistically by being aware.

Briefly, once you get your credit score you can shop for the best Auto Loan, apply smartly, and finalize your purchase. Once you improve your credit score through timely repayments in full, there is an option to refinancing the loan by a traditional car loan. This can reduce the interest rates and get you favorable terms. Now, it is possible to buy a new car with a bad credit score.