Are you curious about what Medicare entails and how it could be beneficial for your healthcare needs and your pocket as well? Whether you’re a curious researcher or simply someone in their middle years looking to understand the basics of this healthcare system better, look no further as we’ll provide an introduction to all the different parts of Medicare: A, B, C, and D. We will break down each part in an easy-to-understand way so that you can make an informed decision about which parts or combination of parts will provide the coverage level you require. Read on to find out exactly why Medicare is such a reliable medical protection and aid source and how these plans contribute to protecting your physical, mental, and financial well-being.

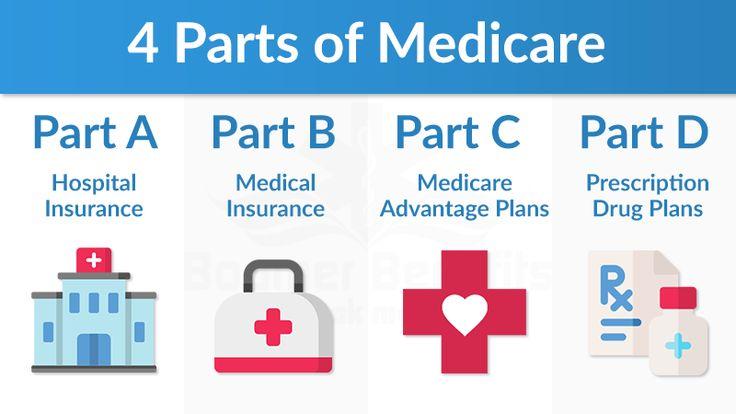

Overview of Medicare and its Four Parts – A, B, C & D

As one gets older, ensuring access to affordable healthcare becomes a top priority. Medicare is a subsidiary program that helps cover medical expenses for individuals who are 65 and older or have certain disabilities. Medicare has four different parts: Part A covers hospital stays, hospice care, and skilled nursing facility care. Part B covers medical services such as doctor visits, preventive care, and diagnostic tests. Part C, also known as Medicare Advantage, is an all-in-one alternative to Original Medicare that includes Part A, Part B, and sometimes Part D. Finally, Part D is a prescription drug coverage plan. It’s worth noting that while Medicare provides coverage for a wide range of services, it doesn’t cover everything. That’s why many people choose to supplement their Medicare benefits with additional coverage such as Medigap or Medicare Advantage. Understanding Medicare’s four parts and what each covers can be daunting, but learning the basics can help you make informed decisions about your healthcare options.

Medicare Part A – Inpatient Care & Hospital Services

Healthcare can be confusing, especially with all the different types of plans and coverage options. If you’ve just started researching Medicare, you might be wondering what Part A covers and who is eligible for it. Part A is often referred to as “hospital insurance.” It is a vital healthcare plan primarily covering inpatient care in hospitals, skilled nursing facilities, hospice care, and certain home health services. This means that if you need to stay in the hospital for medical treatment or surgery, the expenses will be covered under Medicare Part A. It’s important to note that not everyone qualifies for Medicare Part A. To be eligible, you must be 65 years or over or have a qualifying disability or medical condition.

Additionally, you must have paid into Medicare through payroll taxes while working for a certain amount of time. If you meet these criteria, you might be eligible for Part A coverage and will be covered during a hospital stay. Understanding the qualifications and coverage options of Medicare Part A is vital for your healthcare needs and can provide some relief knowing that you are covered.

Medicare Part B – Outpatient Care & Medical Services

Medicare Part B is crucial for those seeking quality healthcare in their golden years. This aspect of the program covers a wide variety of outpatient care and medical services, from doctor visits to diagnostic tests and beyond. Not everyone automatically qualifies for Part B, so it’s essential to know if you meet the criteria before enrolling. Generally speaking, those who are 65 or older and eligible for Medicare Part A are also eligible for Part B. Additionally, those who are under 65 but have certain disabilities or chronic conditions may also qualify. By exploring the ins and outs of Medicare Part B, you can take control of your healthcare and ensure you have access to the resources you need when you need them.

Medicare Part C – Private Health Plans

Medicare Part C, also known as Medicare Advantage, offers a unique alternative to traditional Medicare coverage. With Medicare Part C, individuals can opt for private health plans that offer additional benefits and services, such as vision and dental care. Consider your health needs and medical history to know if this option is right for you. If you require frequent medical attention and a variety of healthcare services, a Medicare Advantage plan may be a better fit for you than traditional Medicare. Plus, private health plans often offer lower out-of-pocket costs than traditional Medicare plans. It’s important to do your research and compare all available plans before making a decision. With Medicare Part C, you have the freedom to choose the plan that best meets your needs and fits your lifestyle.

Medicare Part D – Prescription Drug Coverage

Medicare Part D, also known as prescription drug coverage, is important for individuals who require daily medications to manage their health conditions. It is a program designed to help senior citizens and people with disabilities afford the high cost of medications. The benefits of Medicare Part D can be life-changing, as it provides access to a wide range of prescription drugs at a more affordable price. The best part is that individuals can choose from a variety of plans that work for their needs and budget. With Medicare Part D, patients can have solace in knowing that their medications are covered, and they can focus on living a healthy, fulfilling life. You can try the following site to check out Medicare Part D Prescription Drug Coverage: https://www.medicarepartdplans.org/

Conclusion

Considering all of the options with Medicare, there is something to fit almost everyone’s lifestyle and healthcare needs. From enrolling in a private plan under Medicare Part C or D to achieving peace of mind with Parts A and B, seniors must research the different types of coverage and understand what fits best for them. Furthermore, if any questions still remain after researching Medicare options on one’s own, healthcare professionals can provide further insight into how these parts can be used together. Ultimately, when considering how Healthcare insurance might apply to daily living – beyond tomorrow and beyond retirement – it’s essential to take advantage of the information on the Medicare website. There is no better time than now to familiarize oneself with these options for health insurance coverage!