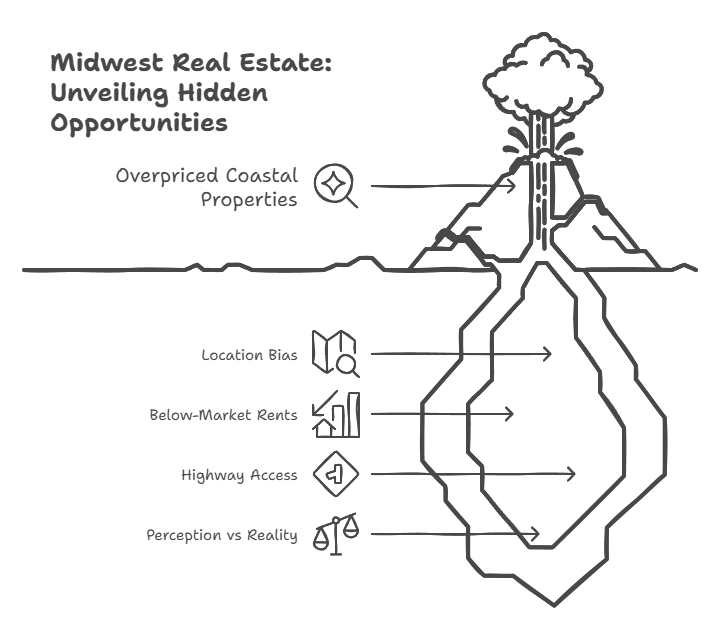

Three years ago, I was like most commercial real estate investors – completely obsessed with coastal markets. I spent my days analyzing overpriced properties in Los Angeles and Miami, competing with dozens of other investors for deals with 4% cap rates and minimal upside potential. Meanwhile, I was dismissing the Midwest as a collection of declining rust belt cities with no growth prospects.

- Why Smart Money Is Quietly Moving to the Midwest

- Reading the Data: What Most Investors Miss About Midwest Markets

- The Hidden Powerhouse Markets Everyone Overlooks

- Sector-by-Sector Analysis: Where the Money Is

- Due Diligence Strategies That Prevent Expensive Mistakes

- Common Mistakes That Destroy Midwest Returns

- The Infrastructure Advantage Nobody Talks About

- Future Trends Reshaping Midwest Commercial Real Estate

- Building a Successful Midwest Commercial Real Estate Strategy

That mindset cost me dearly until a deal in Indiana opened my eyes to what I’d been missing. A colleague mentioned an industrial property that had been sitting on the market for six weeks – an eternity in the current environment. A particular commercial real estate in Indiana showed a 45,000 square foot warehouse facility priced at $2.8 million, which seemed expensive until I realized it was $62 per square foot in a market where new construction was running $120+ per square foot.

The reason it hadn’t sold was simple: location bias. Investors from the coasts couldn’t see past the Columbus zip code to recognize the fundamentals. The property sat at the intersection of three major highways, within 600 miles of 60% of the U.S. population, with direct access to rail and air cargo facilities. The existing tenant was a regional logistics company paying below-market rents on a lease that expired in 18 months.

I bought the property, re-leased it to a national e-commerce fulfillment company at 35% higher rents, and refinanced at 75% LTV within two years. The property is now worth $4.2 million, generating annual returns that make my coastal deals look embarrassing. But more importantly, that deal taught me to recognize the massive opportunity gap between perception and reality in Midwest commercial real estate.

Since then, I’ve completed over $50 million in Midwest commercial real estate transactions, consistently achieving returns that would be impossible in the “hot” markets everyone talks about. The secret isn’t finding hidden gems – it’s understanding why exceptional opportunities exist in plain sight.

Why Smart Money Is Quietly Moving to the Midwest

The migration of capital from coastal markets to the Midwest isn’t a trend – it’s a fundamental reallocation based on economic realities that most investors are still missing. While headlines focus on tech company layoffs and urban office vacancies, a quiet transformation is reshaping the geography of American commerce.

The numbers tell a compelling story that goes far beyond traditional “cheap Midwest” stereotypes. Population growth in key Midwest metros is accelerating while coastal markets stagnate or decline. Columbus, Indianapolis, and Kansas City are growing faster than San Francisco or Seattle, driven by corporate relocations, remote work flexibility, and housing affordability that actually allows people to build wealth.

But population growth alone doesn’t create commercial real estate opportunities – economic diversification does. The Midwest’s transformation from manufacturing-dependent economies to diversified hubs of logistics, healthcare, technology, and financial services creates demand across multiple property sectors simultaneously.

Reading the Data: What Most Investors Miss About Midwest Markets

The biggest mistake I see investors make is analyzing Midwest markets using coastal market assumptions. Traditional metrics like price per square foot or gross rent multipliers tell incomplete stories when land costs, labor costs, and regulatory environments are fundamentally different.

Cap rates in Midwest markets typically run 150-300 basis points higher than comparable coastal properties, but this spread doesn’t reflect higher risk – it reflects market inefficiency and capital allocation patterns that favor familiar markets over fundamental value. A 7.5% cap rate on a Class A industrial property in Indianapolis represents better risk-adjusted returns than a 4.5% cap rate on similar property in Los Angeles when you factor in total cost of ownership and growth potential.

Rent growth trajectories in emerging Midwest markets often outpace established coastal markets because they’re starting from sustainable baselines rather than unsustainable peaks. A market where rents grow 4% annually from sustainable levels delivers better long-term performance than markets where rents grow 2% annually from overextended peaks that face inevitable corrections.

Vacancy rates provide crucial insights, but only when analyzed in context of absorption patterns and new supply pipelines. A 12% vacancy rate in a market with strong absorption and limited new construction indicates opportunity, while a 6% vacancy rate in a market with massive development pipelines signals potential oversupply.

The Hidden Powerhouse Markets Everyone Overlooks

While Chicago and Minneapolis get attention as major Midwest commercial real estate markets, the most compelling opportunities exist in secondary markets that combine strong fundamentals with limited competition for deals.

Indianapolis represents the perfect storm of growth factors that create commercial real estate opportunity. The metro area has added 150,000 jobs over the past five years while maintaining unemployment below national averages. FedEx’s $1.5 billion hub expansion, Amazon’s continued investment in fulfillment infrastructure, and the growing life sciences corridor create demand across industrial, office, and supporting retail sectors.

I’ve completed three deals in Indianapolis submarkets over the past two years, achieving average returns of 34% through a combination of below-market purchase prices, rapid lease-up, and property value appreciation. The key was identifying areas where infrastructure improvements and corporate expansions would drive demand before these changes were reflected in property pricing.

Kansas City offers compelling opportunities in both industrial and multifamily sectors, driven by its position as a logistics hub and growing technology sector. Google’s expansion of its data center operations, Ford’s electric vehicle investment, and continued growth in the financial services sector create diverse demand drivers that reduce market risk.

The most interesting opportunity in Kansas City involves adaptive reuse of older industrial buildings in core urban areas. These properties can be purchased at significant discounts to replacement cost and repositioned for modern logistics users or converted to mixed-use developments that serve the growing downtown residential population.

Sector-by-Sector Analysis: Where the Money Is

Different commercial real estate sectors respond differently to Midwest market dynamics, and understanding these nuances is crucial for successful investment allocation.

Industrial real estate represents the strongest opportunity across most Midwest markets, driven by e-commerce growth, supply chain reshoring, and logistics advantages. Modern distribution facilities in strategic locations consistently achieve occupancy rates above 95% and rent growth exceeding 5% annually.

The key to industrial success in Midwest markets is understanding the difference between commodity warehouse space and specialized facilities that command premium rents. Properties with rail access, highway visibility, and modern loading configurations attract national tenants willing to pay above-market rents for operational advantages.

I recently acquired a 120,000 square foot facility in suburban Indianapolis that had been used for light manufacturing. By investing $1.2 million in dock modifications and warehouse layout improvements, we attracted a national third-party logistics provider at 40% above the previous rent level, creating immediate value appreciation of $3.8 million.

Multifamily properties in Midwest markets benefit from sustained in-migration and housing affordability challenges that make renting attractive for broad demographic groups. Unlike coastal markets where rental demand comes primarily from people who can’t afford to buy, Midwest rental demand includes professionals who choose to rent for lifestyle flexibility.

The most successful multifamily investments focus on properties that serve the 25-45 age demographic in submarkets with employment growth and lifestyle amenities. Properties near universities, medical centers, and urban cores consistently outperform suburban garden-style apartments, even when purchase prices appear higher initially.

Due Diligence Strategies That Prevent Expensive Mistakes

Midwest commercial real estate investing requires different due diligence approaches than coastal markets, reflecting differences in market maturity, regulatory environments, and local business practices.

Environmental assessment deserves extra attention in Midwest markets due to the region’s manufacturing history. Properties that appear clean may have contamination from previous industrial uses, and environmental remediation costs can exceed property values in severe cases. I always recommend Phase I environmental assessments as standard practice, with Phase II testing when any red flags emerge.

One deal I almost completed involved a former automotive parts manufacturing facility that had been converted to office use. The Phase I assessment revealed potential soil contamination from historical operations, and Phase II testing confirmed contamination levels that would have required $800,000 in remediation costs. Walking away from that deal saved far more than the $15,000 invested in environmental assessment.

Local market verification involves more than analyzing demographic and economic data – it requires understanding local business conditions, regulatory environments, and infrastructure plans that affect property values. Municipal development plans, school district quality changes, and major employer expansion or contraction plans significantly impact commercial real estate demand.

Common Mistakes That Destroy Midwest Returns

After seeing numerous investors struggle with Midwest commercial real estate, I’ve identified patterns in mistakes that lead to disappointing results.

Underestimating local market complexity causes many investors to assume Midwest markets are simpler than coastal markets. In reality, these markets often have more complex regulatory environments, stronger local business networks, and different tenant expectations that require market-specific expertise.

Over-relying on national data without local verification leads to investment decisions based on incomplete or misleading information. National databases often have incomplete coverage of secondary markets, and local market conditions may differ significantly from metropolitan statistical area averages.

Inadequate property management becomes a bigger problem in Midwest markets where local relationships and market knowledge matter more than in institutional-grade coastal markets. Property management companies that work well in major markets may lack the local expertise needed for success in secondary markets.

The Infrastructure Advantage Nobody Talks About

One of the Midwest’s most undervalued commercial real estate advantages is infrastructure quality and capacity that enables business growth without the constraints common in coastal markets.

Transportation networks provide competitive advantages for logistics-dependent businesses that translate directly into commercial real estate demand. The ability to reach major population centers within one-day truck delivery, combined with rail and air cargo access, makes Midwest locations increasingly valuable as supply chain efficiency becomes more important.

Utility infrastructure offers reliable, affordable electricity and water service that supports manufacturing and data center operations. While this might seem mundane, utility reliability and cost advantages become significant competitive factors for businesses choosing facility locations.

Telecommunications infrastructure has improved dramatically in Midwest markets, with fiber optic networks now available in most commercial districts. This infrastructure development eliminates previous disadvantages that limited technology company growth in secondary markets.

Future Trends Reshaping Midwest Commercial Real Estate

Understanding emerging trends helps identify investment opportunities before they become widely recognized and competitively priced.

Remote work normalization benefits Midwest markets disproportionately by removing geographic constraints that previously limited talent access. Companies can now access skilled workers regardless of location while benefiting from lower operating costs, creating demand for flexible office space and supporting retail and service businesses.

Supply chain regionalization driven by pandemic experiences and geopolitical concerns favors Midwest locations for manufacturing and distribution operations. Companies are prioritizing supply chain resilience over pure cost optimization, creating opportunities for industrial real estate in markets with transportation and workforce advantages.

Climate migration from areas affected by extreme weather, wildfires, and rising sea levels will likely accelerate over the coming decade. Midwest markets with stable weather patterns, water availability, and affordable housing will benefit from this population shift, creating sustained demand across all commercial real estate sectors.

Building a Successful Midwest Commercial Real Estate Strategy

Success in Midwest commercial real estate requires different approaches than coastal market investing, but the principles that generate superior returns remain consistent: buy quality properties at reasonable prices, maintain them properly, and benefit from market growth over time.

Market selection should focus on metros with diverse economic bases, growing populations, and business-friendly environments. Avoid markets dependent on single industries or employers, regardless of how attractive current conditions appear.

Sector diversification across industrial, multifamily, office, and retail properties reduces risk while capturing opportunities in different market cycles. Each sector responds differently to economic changes, and diversification provides more stable cash flows and appreciation potential.

Local partnership development with experienced brokers, property managers, contractors, and other professionals provides market knowledge and execution capability that can’t be developed quickly from a distance. These relationships also provide access to off-market opportunities and help avoid costly mistakes.

Conservative underwriting with realistic assumptions about operating costs, capital improvements, and market growth provides protection against unexpected challenges while allowing for upside when markets perform better than expected.