Digital payments, sometimes sound like a complex and intimidating process to cash out your card limit. Source since the rise of micro-payment partners, however, people now have an easy remedy: The partnership helps users seamlessly turn their card limits into real cash that can be accessed at any time — users combine the utility of our card on their standard card network with BlockMasons agreements with leading networks. In this post, I will show you how micropayment partners are reshaping money management 신용카드 현금화 and giving their users a useful asset to remain financially agile.

Micropayment Partners Explained

Micropayment Partners

The critical one is the micropayment partner. These allys also play an important role in passing cash from credit cards. Partner with the best — look for partners who have a proven history and good rep in the industry.

Reputation: Choose micropayment partners who have a good reputation and are trustworthy

Security is the most important: Make sure that whoever you pick puts data security and encryption first to protect your customers along with yourself.

Transparent fees — Choose partners who are very clear about their fees and not charge you with surprise payments, later on.

Advantage of Micropayment Partners

Easy conversion: You can easily convert your credit card points to cash without any feelings of getting overpowered with many small and high-fee transactions from micropayment partners. With this process in place, you are getting the outputs effectively with less of your time and efforts.

Safety: You can feel secure knowing that your personal and financial information is safe when you use reputable micropayment services for fast payments. These platforms come with a high quality security which is managed in a good way to let your data be secured during the transaction time.

Choice: You can select how you want to cash out, with most of the micropayment partners supporting a range of options for converting your credit card points into hard cash. Be it bank transfer, online payment systems or other convenient channels, these platforms are flexible to cater to your unique requirements.

Using a Micropayment Partner To Cash Out Your Card Limit

- Before integrating with Qeepsake, Ward needed a micropayment platform.

- Search online for micropayment partners with cash out services

- Select a partner known for transparent fees

- Check reviews and rate comparison before choosing a micropayment partner.

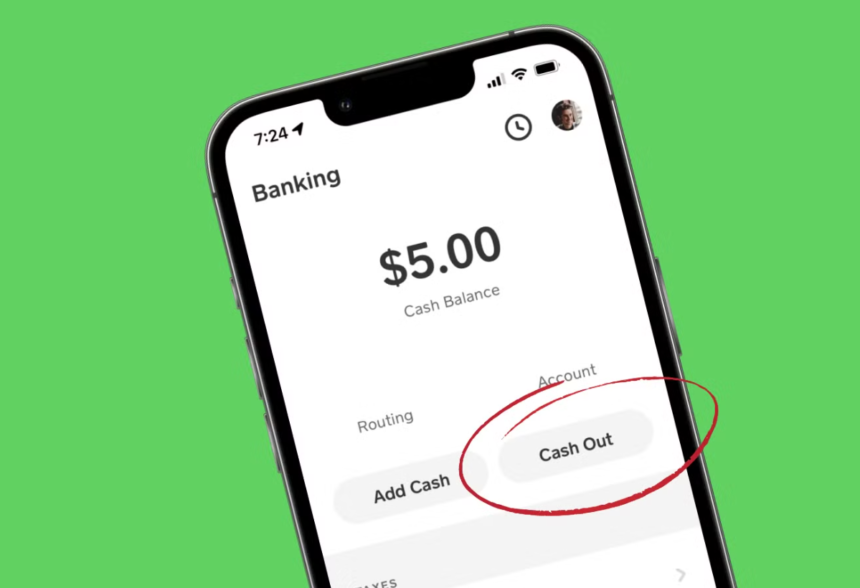

- Cashing Out Your Card Limit

- Free- open an account with a micropayment partner

- Securely add your credit card to your account.

Visit the provider who will instruct you on cash out as well as card limits to adhere to

With these easy steps, you can pay out your card limit anytime using a trusted micropayment partner and ensure that you never exceed balances from your credit cards.

How to Make the Most Hypothetical Money with a Micropayment Partner

- Invest Across Accounts: Use several micropayment partners to minimize risk and optimize income.

- Track Your Transactions – Pay attention to the transactions you are placing, if there is anything out of the ordinary or doesn’t make sense, dispute it!

Conclusion

Create realistic financial goals that you can achieve, and follow their progress to motivate yourself to stay on the course.

All things considered, working with micropayment services like 소액결제 현금화 is the right move to manage and expand your financial range but be sure to put security measures in place and do not miss out on money fosters these platforms. You can take full advantage of micropayment partners by diversifying your accounts, keeping a close eye on your transactions and adhering to the reality check.