Rising costs of living, loans, and unpredictable health expenses make financial protection essential. Term insurance is the simplest way to secure your family’s future, and buying it online ensures affordability, transparency, and convenience. The challenge is choosing wisely from numerous options.

- Why Buy Term Insurance Online?

- Determine the Right Coverage

- Select the Ideal Policy Term

- Evaluate Insurer Credibility

- Understand the Role of Riders

- Disclose Information Honestly

- Medical Tests and Their Importance

- Choosing Payout Options

- Compare Policies Beyond Premiums

- Smart Hacks for Customers in India

- Common Pitfalls to Avoid

- How to Make the Final Decision

- Take the Next Step Towards Securing Your Family’s Future

This guide shares expert tips to help you buy term insurance that provides the right balance of cover, trust, and long-term value.

Why Buy Term Insurance Online?

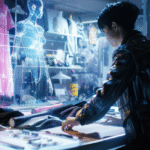

Online platforms have changed the way consumers evaluate and purchase financial protection. Buying online helps you compare insurers, examine features, and check claim statistics instantly. Premiums are usually lower as there are no intermediaries involved.

You also gain access to policy documents in a secure digital format. For many individuals, this ease of comparison and transparent purchase process is the biggest advantage of opting to buy term insurance online.

Determine the Right Coverage

The most important step is calculating the sum assured. A general rule is 15 to 20 times your annual income, adjusted for existing loans and future expenses. For example, if your annual income is ₹12 lakh and you have ongoing liabilities worth ₹30 lakh, the right cover may range from ₹2 crore to ₹2.5 crore. When you buy term insurance, ensure that your chosen amount secures your dependents’ needs over the long term.

Select the Ideal Policy Term

The policy term should ideally cover your working years. For most professionals, a policy term of 60 or 65 years is sufficient. While some insurers provide coverage up to 85 or 99 years, higher terms may increase premiums unnecessarily. Consumers should buy term insurance that extends protection until retirement, aligning with income replacement requirements.

Evaluate Insurer Credibility

A policy is only as reliable as the company that issues it. Two key indicators to check are:

- Claim Settlement Ratio (CSR): A higher ratio indicates greater reliability in honouring claims. Look for insurers with CSR above 95 percent.

- Solvency Ratio: This shows financial strength. IRDAI requires a minimum of 1.5, but a higher ratio reflects stability.

When planning to buy term insurance, these parameters provide confidence that claims will be settled without delay.

Understand the Role of Riders

Riders strengthen your base policy and should be chosen with care. Critical illness cover ensures protection against major diseases. An accidental death benefit provides an additional payout in case of accidental demise.

Waiver of premium is useful if you face disability or illness. Riders add value, but unnecessary additions can increase your premium. Buy term insurance with essential riders only, aligned to your lifestyle and family’s needs.

Disclose Information Honestly

Full disclosure is critical during the proposal stage. Health conditions, existing policies, lifestyle habits, and income details must be declared correctly. Withholding information can lead to claim rejection.

Online platforms provide user-friendly forms where all details can be entered transparently. When you buy term insurance, accuracy ensures your family will not face disputes later.

Medical Tests and Their Importance

Insurers usually require medical examinations before issuing a policy. These checks validate your health profile and strengthen claim approval. Policies issued without medical tests may appear convenient, but they carry a higher chance of claim disputes. Always complete the medical process when you buy term insurance, as it strengthens the credibility of your contract.

Choosing Payout Options

Consumers often focus only on the sum assured, but the payout structure is equally vital. Policies offer lump-sum payout, monthly income, or a combination of both. A combined option is practical as it ensures immediate financial relief and continued income support.

Families benefit more from regular income, especially when managing household expenses. Consider this flexibility when you buy term insurance online.

Compare Policies Beyond Premiums

Premium cost is often the first factor people check, but it should not be the only criterion. A slightly higher premium from a reputable insurer is more beneficial than choosing the lowest cost with poor service.

Review digital claim processing, customer support quality, and turnaround time for settlements. Smart customers buy term insurance from providers who balance affordability with proven reliability.

Smart Hacks for Customers in India

Small changes in how you approach a policy can help you buy term insurance that delivers stronger cover without unnecessary costs.

- Start Early: Premiums are lower in your 20s and 30s. Delaying increases costs significantly.

- Check for Increasing Cover: Some plans allow enhancement of cover during milestones like marriage or childbirth.

- Look for Discounts: Non-smokers, salaried employees, and women may receive preferential rates.

- Split Cover: Buying policies from two insurers reduces dependency on a single provider.

- Review Periodically: Reassess coverage every three to five years to adjust for rising expenses and inflation.

These practices help you buy term insurance that evolves with your life stage and responsibilities.

Common Pitfalls to Avoid

Many buyers make errors that weaken protection or increase premiums; avoiding these mistakes ensures your term plan stays dependable for decades.

- Underestimating Coverage: ₹50 lakh may appear significant today, but it will not meet future inflation-adjusted needs.

- Ignoring Exclusions: Always read exclusions carefully. Suicide in the first year and undisclosed illnesses are standard exclusions.

- Overloading on Riders: Adding all riders increases the premium unnecessarily.

- Not Updating Nominee: Update nominee details promptly after marriage, birth of children, or other life events.

Avoiding these mistakes ensures that when you buy term insurance, the policy remains relevant and dependable.

How to Make the Final Decision

Once you have shortlisted insurers based on CSR, solvency, and reputation, compare coverage, riders, and payout structures side by side. Use official IRDAI reports and licensed aggregators for accurate comparisons.

Select the plan that provides comprehensive protection within your budget. When you buy term insurance online, keep records safe, store your policy in DigiLocker if possible, and ensure family members know where documents are located.

Take the Next Step Towards Securing Your Family’s Future

Financial protection is not an optional purchase but a necessity for anyone with dependants. With the convenience of digital platforms, consumers can now compare, assess, and buy term insurance more effectively than ever before.

The right policy offers long-term peace of mind, ensuring your family’s financial independence even in your absence. You can contact online insurance brokers like Jio Insurance Broking Ltd. for guidance in securing the right policy tailored to your needs.